Cognition Therapeutics president and CEO

With Eisai and Biogen winning full FDA approval in July for Leqembi® (lecanumab-irmb), and Eli Lilly expecting an agency decision on donanemab by year’s end, a much smaller drug developer insists there’s room for many more Alzheimer’s disease (AD) drugs to reach the market—including its lead pipeline candidate, which is designed to treat the memory-robbing brain disorder.

Cognition Therapeutics’ CT1812 is a once-daily, oral, brain penetrant small-molecule antagonist of the sigma-2 receptor (S2R) that has completed one Phase II trial in mild-to-moderate AD, SEQUEL (COG0202; NCT04735536).

CT1812 is also in a second Phase II trial in mild-to-moderate AD, SHINE (COG0201; NCT03507790) as well as other Phase II studies in early-stage AD and in dementia with Lewy bodies (DLB), the second most common type of dementia—as well an eye disease indication, geographic atrophy caused by dry age-related macular degeneration (dry AMD).

Can Cognition succeed where so biopharma companies, large and small, have failed, namely in developing AD drugs that are safe and effective enough to enter a market expected to be disrupted by Leqembi and, possibly, donanemab as well?

“The disease is so large, and the requirements are vast worldwide—regulatory, worldwide manufacturing and distribution. I think everyone understands this to be largely the remit of large companies, and I think investors are motivated by that,” Cognition president and CEO Lisa Ricciardi told GEN Edge.

“[Investors] see us advancing and that’s what makes them interested in continuing to speak to us. So no, Leqembi has not obviated the market. I’d say the opposite is true.”

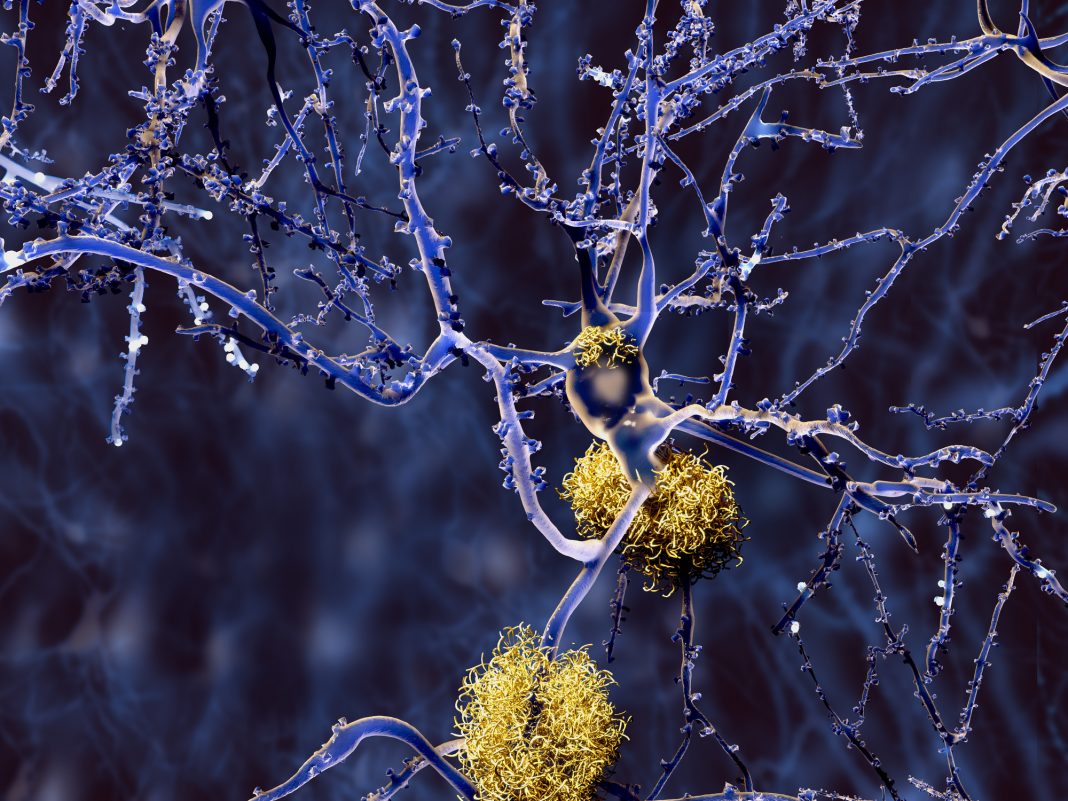

CT1812 is designed to work by displacing amyloid beta (Aβ) oligomers, a pathogenic form of amyloid plaques produced early in AD, in order to prevent their toxic effects on neurons. By binding to a synaptic receptor, Cognition says, CT1812 has shown the ability to reach its therapeutic target through a high degree of blood brain barrier penetration.

Over the summer, Cognition announced positive topline results from SEQUEL, showing CT1812 to have positively impacted neurophysiological endpoints such as synapse activity and connectivity. Full study results are expected this week at the Clinical Trials on Alzheimer’s Disease (CTAD) conference (October 24–27) in Boston.

Removing oligomers

“We started the SEQUEL trial because of our observations in the dish that when we remove the Aβ oligomers, we very rapidly returned synapse proteins to these neurons,” said Anthony Caggiano, MD, PhD, Cognition’s chief medical officer and head of R&D. “We wanted to see if, by treating individuals with CT1812 and removing those oligomers, if we could shift those EEG patterns back towards what you see in normal individuals. Indeed, that’s exactly what we did.”

Caggiano said researchers from Cognition partnered with Everard (Jort) Vijverberg, MD, PhD, a neurologist and senior researcher at the Amsterdam University Medical Centers, and colleagues given their expertise in EEG and research over two decades showing that the EEG patterns of patients with dementia basically slow down compared to healthy controls.

Cognition’s chief medical officer and head of R&D

“We used a crossover design of 16 individuals, and were able to demonstrate that we could normalize certain wave bands that are aberrant in people with dementia. So, this is a very nice physiologic signal of effects of CT1812 in four weeks,” Caggiano added.

Cognition is now recruiting patients for another Phase II study, START (COG0203; NCT05531656), in which an estimated 540 adults with early AD (MMSE 20-30) and who have elevated amyloid beta (Aβ) are being randomized to CT1812 or placebo for 18 months.

START is being conducted at about 50 sites in North America, including more than 30 top-tier academic institutions within the Alzheimer’s Clinical Trials Consortium (ACTC), founded in 2018 with funding from the NIH’s National Institute on Aging. The NIA has awarded an approximately $81-million grant to fund the study—about half of the approximately $171 million in NIA grants won by Cognition toward its trials.

Downs and ups

Cognition hopes such interest from investors will translate into a more valuable stock that can rise above recent downs and ups. After peaking at $3.38 on June 16, ahead of the company’s topline results from SEQUEL, the stock has declined by more than half, in part due to a price-target downgrade August 14. Aydin Huseynov, MD, managing director, biotechnology equity research at Ladenburg Thalmann, cut his firm’s 12-month price target from $10 to $6.

Cognition’s stock has hovered in the low $1 per share range in recent weeks—though of late it has been climbing. Last week, shares rose 15%, to $1.29, rallying after Cognition announced it would present new data for CT1812 at CTAD.

Alzheimer’s has been a notoriously difficult indication for drug developers. Only a handful of drug successes have ever reached the market, most of which have merely slowed progression of symptoms by six to twelve months.

A 2014 Cleveland Clinic study found a 99.6% failure rate of clinical trials for AD drug candidates between 2002 and 2012. That study found high attrition rates for AD treatments, with 72% of agents failing in Phase I, 92% failing in Phase II, and 98% failing in Phase III.

Now, with Leqembi and donanemab succeeding in the clinic, Ricciardi said, investors of Cognition now realize that the biopharma giants that developed those drugs have created a market that other giant drug developers need to enter as well: “I think there’s a clear message that there’s an opportunity for innovative companies like us to bring forward therapies that would be of interest to the pharma companies.”

Does that mean Cognition will inevitably sell off CT1812 or other Cognition candidates with AD indications to one or more partners?

Coming to the table

“We’re not commenting on what shape the transaction will take,” Ricciardi replied. “I think they (investors) are willing to come to the table and talk and support us going forward, because they believe there’s going to be a real market. If you have to reach six million people in the U.S. through neurologists and primary care doctors and then patients all over the globe, it’s probably going to be a big company that does it. I’m not contemplating what that looks like. We’re too early.”

Two such big companies, Eisai and Biogen, have gained FDA authorizations for a pair of amyloid-targeting AD drugs—Leqembi, and Aduhelm® (aducanumab-avwa), which won a controversial but historic FDA approval in 2021 as the first therapy indicated for reducing clinical decline in AD patients. Leqembi became the first disease-modifying treatment for AD when it received full FDA approval.

Lilly may join them if it succeeds in obtaining an FDA nod for donanemab. All other FDA-approved Alzheimer’s drugs merely lessen or stabilize symptoms for a limited time by affecting chemicals involved in carrying messages among and between the brain’s nerve cells. They include:

- Cholinesterase inhibitors, including Aricept® (donepezil), Exelon® (rivastigmine), and Razadyne® (galantamine).

- Glutamate regulators such as Namenda® (memantine)

- A combination treatment combining cholinesterase inhibitor and glutamate regulator, Namzaric® (donepezil and memantine).

Within the realm of AD drugs targeting amyloid plaques, Cognition insists it can play a substantive role as CT1812 targets the S2R. While there are several proteins and pathways implicated in contributing to age-related diseases, the S2R acts as a regulator of cellular damage associated with various age-related degenerative diseases of the central nervous system.

Leqembi, by contrast, is a recombinant humanized immunoglobulin gamma 1 (IgG1) monoclonal antibody directed against aggregated soluble and insoluble forms of Aβ. Leqembi won full FDA approval in July, seven months after obtaining accelerated approval.

Billions in sales

Morningstar has projected that Eisai and Biogen will generate a combined $4 billion from Leqembi, with Biogen to reap a $700-million share of profits. Morningstar forecasts an even higher $4.877 billion in 2027 sales for donanemab, an amyloid plaque-targeting therapy that has shown positive Phase III results.

“What makes it difficult to size the market right now is, Leqembi is not seeing significant sales this year,” Karen Andersen, CFA, Morningstar senior strategist, biotechnology, told GEN Edge. Biogen reported in the second quarter that Leqembi’s commercialization expenses will surpass its revenue in 2023, reducing net revenue by $39.6 million in the first half of this year.

While sales aren’t expected to be significant this year or next, 2025 is when Eisai and Biogen could start to see much more significant sales, Andersen said, based on expected improvements in getting patients diagnosed, such as the development of new blood based tests, or administration subcutaneously at home rather than having patients coming to busy infusion center.

“It’s going to take a little bit of time. But once it does, I think these are going to be very popular medicines,” Andersen added.

In July, Lilly published full results in JAMA from the Phase III TRAILBLAZER-ALZ 2 trial (NCT04437511) showing donanemab to have significantly slowed cognitive and functional decline in people with early symptomatic AD at 76 weeks post-treatment.

Among 1,182 participants with low-to-medium levels of tau, donanemab treatment significantly slowed decline by 35% on the integrated AD Rating Scale (iADRS), and by 36% on the Clinical Dementia Rating-Sum of Boxes (CDR-SB). Among all 1,736 amyloid-positive early symptomatic AD study participants, treatment with donanemab significantly slowed decline by 22% on iADRS and 29% on CDR-SB.

Decreasing theta power

Cognition’s completed SEQUEL trial in mild-to-moderate AD showed that treatment with CT1812 was associated with decreases in relative theta power (moving towards normalization) in frontal, central, temporal and posterior (occipital and parietal) regions of the brain, with statistical significance in the change in relative theta in the central region. That result, according to Cognition, suggests that CT1812 treatment has a beneficial effect on brain activity.

SEQUEL also examined global brain wave changes over four weeks of treatment, showing that participants treated with CT1812 experienced a numerical reduction in relative theta power compared when they were on placebo. That reduction was deemed to be not statistically significant, Cognition acknowledged, but added that it still indicated a positive impact on underlying brain function, as supported by nominally significant and directionally positive changes in amplitude envelop correlation (AECc) and alpha power.

CT1812 fared well in three earlier clinical studies. In March at the AD/PD™ 2023 conference in Gothenburg, Sweden, Cognition presented positive biomarker data for CT1812 in adults with mild-to-moderate AD from a meta-analysis of a complete dataset of the Phase Ib portion of the Phase I/II SPARC trial (COG0105; NCT03493282) and the first cohort of 24 participants in the Phase II SHINE trial (COG0201; NCT03507790). The proof of concept SHINE study was funded with an approximately $30.5-million grant from the NIA.

CT1812 showed a significant impact on cerebrospinal fluid (CSF) levels of clusterin (CLU), a genetic risk factor for AD and a mediator of amyloid toxicity. CT1812 treatment also led to a significant shift in levels of prion protein (PRPN), a major constituent of the Aβ oligomer receptor complex and the receptor component to which Aβ oligomers bind.

“We were able to demonstrate a nice slowing of cognitive decline as measured by one of the typical outcome measures used in AD. That was a very nice early indication that we could impact cognition,” Caggiano said.

And in the Phase Ib SNAP trial (COG0104, NCT03522129), CT1812 demonstrated target engagement by rapidly displacing Aβ oligomers from synapses, as shown by sharp increases in CSF Aβ oligomer levels in two of three patients: Up by > 250% of baseline in Patient 3 and up by > 500% in Patient 1, whose exposure to the drug was more than twofold higher, according to data published in May in Translational Neurodegeneration. No change was seen in Aβ oligomer levels in Patient 2.

Other clinical trials in progress evaluating CT1812:

- Dementia with Lewy Bodies (DLB)—CT1812 is being assessed in the Phase II SHIMMER trial (COG1201; NCT05225415), which completes recruitment this year of about 120 patients ages 50-80 diagnosed with mild to moderate DLB. The study’s estimated primary completion date is April 15, 2024. SHIMMER has been funded with an approximately $29.5 million grant from the NIA.

- Geographic atrophy caused by dry AMD—CT1812 is under study in the Phase II MAGNIFY trial (COG2201; NCT05893537), which is expected to enroll approximately 246 adults. The first patient was dosed with CT1812 in July.

GA caused by dry AMD has two therapies marketed to patients. Apellis’ Syfovre® (pegcetacoplan injection) received the first-ever FDA approval for a GA therapy in February, but safety questions surfacing over the summer caused the company’s stock to sharply nosedive. In August, Iveric Bio, a wholly-owned subsidiary of Astellas Pharma, won FDA authorization for its own drug indicated for GA secondary to AMD, a complement C5 inhibitor marketed as Izervay™ (avacincaptad pegol intravitreal solution). Astellas acquired Iveric for $5.9 billion, in a deal completed in July.

Also in Cognition’s pipeline are two preclinical next-generation S2R modulators —CT2168, being developed for DLB and other synucleinopathies that include Parkinson’s disease; and CT2074, being developed for dry AMD. Cognition has data indicating that CT2168 has activity in α-synuclein assays, indicating the potential to alleviate α-synuclein oligomer-induced neurotoxicity. As for CT2074, the company says it has shown activity in cell-based dry AMD assays, suggesting the potential to maintain homeostatic functions of retinal pigment epithelial cells (RPEs), ameliorate lysosomal dysfunction, and prevent RPE cell death.

Ricciardi said Cognition views SHIMMER, like SHINE, as a key catalyst toward validation of its platform.

“This time next year, I’m hoping Tony’s buying his shuttle ticket to get to Washington for an end of Phase II meeting with the FDA,” Ricciardi said.

Alex Philippidis is Senior Business Editor of GEN.