Headquartered in Winooski, VT, BioTek specializes in the design, manufacture, and distribution of life science instrumentation that includes cell imaging systems, microplate readers, washers, dispensers, automated incubators, and stackers.

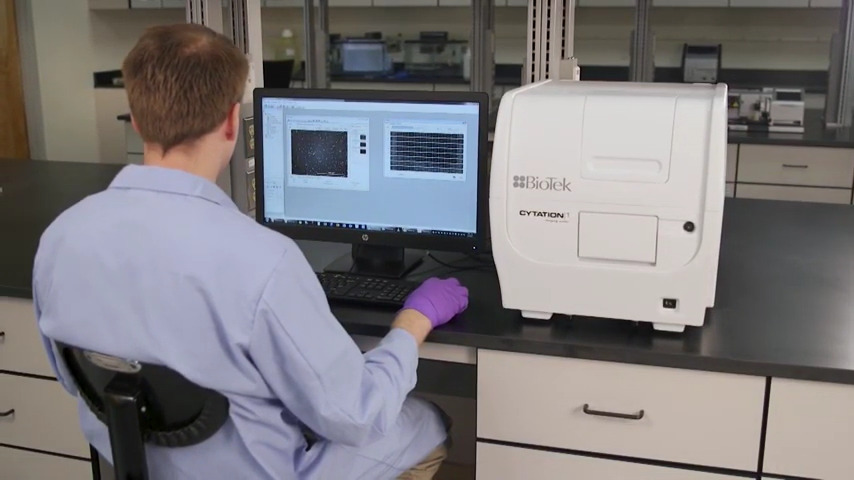

BioTek and Agilent have partnered for more than a year; in April 2018, the companies announced an integrated solution designed to combine cellular metabolic analysis and imaging technologies by integrating the Agilent Seahorse XFe96/XFe24 Analyzer with the BioTek Cytation 1 Cell Imaging Multi-Mode Reader.

“Combining our technology together, we aimed to provide deeper insights to the researchers and the biopharma and the pharma space, than you could if you look at the different technologies separately,” Jacob Thaysen, president of Agilent’s Life Sciences and Applied Markets Group, told GEN.

“The acquisition of BioTek will really solidify our position in cell analysis, and particularly in the spaces of immuno-oncology and immunotherapy overall,” Thaysen added. “BioTek was just the right acquisition that had a very strong position in the overall plate-reader environment, but specifically also imaging of live cells, so it fit very well into the portfolio that we have built up over the years.”

Agilent began building that portfolio in 2015, when it shelled out $235 million cash to acquire Seahorse Bioscience, a provider of instruments and assay kits for measuring cell metabolism and bioenergetics. The deal gave Agilent Seahorse’s XF technology, which is designed to help scientists study the role of cell metabolism, through analyzers that measure oxygen consumption rate (OCR) and extracellular acidification rate (ECAR) of live cells in a multi-well plate, interrogating key cellular functions such as mitochondrial respiration and glycolysis.

Last year, Agilent continued pursuing its multi-year growth strategy in cell analysis by expanding its portfolio with a pair of acquisitions. The company rang in 2018 by purchasing Luxcel Biosciences for an undisclosed price, in a deal intended to expand the buyer’s cell-analysis portfolio with assay kits designed for ease-of-use and compatible with industry-standard plate readers.

In November, Agilent completed a $250 million acquisition of ACEA Biosciences, integrating into its offerings ACEA’s cell analysis instruments for life science research and clinical diagnostics.

“That gave us actually a very nice, but I would say niche, position in the ability to measure live cells, which really allowed us to start to play into overall cell analysis, especially into immuno-oncology,” Thaysen said.

10% revenue growth

Privately-held BioTek generated 2018 revenues of $162 million, a figure that Agilent said is expected to grow approximately 10% this year, following a compound annual growth rate of 12% over the last three years.

In its presentation to investors detailing the deal, Agilent disclosed that pharma and biotech customers accounted for 45% of Biotek’s revenue, followed closely by the 41% of revenue generated by academic and research customers. Government users accounted for 10% of revenue, with the remaining 4% in other sectors.

More than half of BioTek’s revenue (56%) is generated in the Americas, followed by Europe (18%), China (16%), and the rest of Asia (10%).

The acquisition is expected to be completed in Agilent’s fiscal fourth quarter, which runs from August through October, subject to regulatory approvals and customary closing conditions. Due to anticipated tax benefits, the net price to Agilent is expected to be approximately $1.05 billion.

Once the deal is closed, Agilent said, its total cell analysis business will have grown to more than $250 million in annual revenues. Cell analysis would remain less than 10% of Agilent’s total revenues, which were $4.91 billion in its 2018 fiscal year, ending October 31.

Agilent has projected FY 2019 revenues of $5.085 billion to $5.125 billion, a range it lowered in May from $5.15 billion to $5.19 billion following a 1% revenue dip for its Life Sciences and Applied Markets Group, blamed on weakened demand in the pharma and food markets.

The company has maintained its non-GAAP earnings per share guidance ranging from $3.03 to $3.07 per share. Agilent has projected that its purchase of BioTek will add 2 to 4 cents to its non-GAAP earnings per share in the 2020 fiscal year that starts November 1, with growth expected to compound thereafter.