June 15, 2009 (Vol. 29, No. 12)

Diverse Delivery Technologies Drive Sales in Cancer and Noncancer Breakthrough Pain

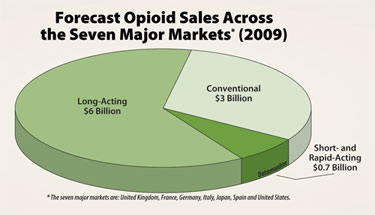

Opioids (or opiates) have been the gold-standard drug class for severe pain relief for millennia. Despite its maturity, the global prescription opioids market was worth in excess of $10 billion in 2008. Significant market value has been maintained in the presence of nonbranded generics over the last few decades via drug delivery reformulations (e.g., fixed dose combination, controlled-release, patch), providing both market exclusivity and the possibility of a high price point.

As a result, distinct opioid sub-markets can now be identified based on the speed and length of action, convenience, and route of delivery. One such market is the emergence of short- and rapid-acting opioid formulations specifically designed to tackle breakthrough pain.

Common in late-stage cancer patients, breakthrough pain is a transient exacerbation of pain that occurs in those with otherwise stable, baseline-persistent pain. Breakthrough pain can also afflict noncancer patients suffering from conditions such as arthritis, low-back pain, and diabetic neuropathy.

Cephalon effectively created the short- and rapid-acting opioids market in 1998 when it launched Actiq (oral transmucosal fentanyl citrate), a lollipop formulation of fentanyl indicated for breakthrough cancer pain in opioid-tolerant patients. Actiq provided both a rapid onset of action (approximately 15 minutes) and a short duration of action (approximately two hours).

Forecast opioid sales across the seven major markets (2009)

(*The seven major markets are: U.K., France, Germany, Italy, Japan, Spaing and the U.S.)

Off-Label Prescribing

Cephalon launched a follow-on product to Actiq in 2006 in the U.S. Fentora (buccal fentanyl) is an effervescent buccal formulation of fentanyl, producing a quicker onset of action than Actiq at approximately 10 minutes. Generic versions of Actiq were also launched in 2006 in the U.S., providing nonbranded competition in the short- and rapid-acting opioids market.

The global short- and rapid-acting opioids market grew to nearly $800 million in 2007; however sales of this drug class declined in 2008 to around $700 million. While a proportion of this global downturn can be attributed to generic Actiq incursion in the U.S., this cannot explain the reduction in total volume of short- and rapid-acting opioid units sold (including generics) observed in 2008.

The drop in volume sales is likely a result of reduced off-label prescribing. In 2007, Cephalon agreed to settle a large lawsuit concerning marketing of Actiq for nonapproved indications in the U.S. As a significant proportion of Actiq’s prescriptions were off-label in noncancer indications (up to 80%), this spotlight on Cephalon’s marketing practices has hit sales of its breakthrough pain franchise.

Relying on predominantly breakthrough cancer pain patients has restricted the revenue potential for Fentora when compared with Actiq a few years earlier. In addition, Cephalon severely cut promotional spending on Fentora in the U.S., possibly as a result of the heightened scrutiny regarding marketing messages and the need to ensure that only cancer breakthrough pain patients were being targeted.

In order to enhance the revenue potential of Fentora in this more stringently monitored environment, Cephalon is seeking a broad noncancer breakthrough pain indication in the U.S.

Actiq and Fentora could be useful pharmacological tools for patients suffering from noncancer breakthrough pain if managed appropriately. The off-label prescribing observed with Actiq demonstrates the demand for such medication in noncancer breakthrough pain. Although delayed, Datamonitor believes that Fentora will receive the noncancer pain label being sought, both opening up a future market and serving a clear unmet need for patients.

Drug Delivery

Attracted by the significant revenue generation of Actiq at peak (global sales of $650 million in 2006), a large patient base, and comparatively low market entry barriers, short- and rapid-acting opioids have become a target for drug delivery and specialty companies keen to leverage their technology platforms. With a well-established efficacy and safety profile, opioids represent an ideal drug class for drug delivery companies as clinical trial risk is reduced. Although the degree of novelty varies significantly, all of the late-stage pipeline drugs are reformulations of established molecules.

In addition to oral dissolvable formulations such as BioDelivery Science’s and Meda’s Onsolis and ProStrakan’s Abstral, significant activity can be observed in the late-stage pipeline for spray formulations of fentanyl. While oral dissolvable formulations offer competition to Cephalon’s franchise, the spray formulations offer a clear improvement on speed of action—a key characteristic for any breakthrough pain drug.

For example, Archimedes’ intranasal formulation of fentanyl, Nasalfent, has shown significant analgesia as early as five minutes following administration. Alternative spray formulations in development include Akela Pharma’s inhaler, Fentanyl TAIFUN, and Nycomed’s intranasal formulation, Instanyl.

Reinvigoration of the U.S. Market

Reinvigoration of the U.S. market is expected following approval of Fentora for noncancer pain and the launch of several new brands over the next few years. Datamonitor forecasts the U.S. market to grow from $600 million in 2008 to $1.1 billion in 2018.

While the clinical advantage of improved speed of onset of action demonstrated with spray formulations is promising, concerns regarding overdose potential may restrict the use of such formulations to a narrow patient population of breakthrough cancer pain patients. With no significant U.S. marketing partner currently signed-up to market a fentanyl spray formulation, potential partners appear to be waiting for an indication of the FDA view of this mode of delivery for strong opioids.

In contrast, should Cephalon prove successful in gaining a broader label for Fentora, new market entrants with dissolvable fentanyl formulations are likely to follow suit, expanding their revenue potential substantially.

Local Marketing Companies

ProStrakan recently launched Abstral in the EU. This will be competing with Cephalon’s Actiq and also its recently launched European Fentora brand Effentora. The entry of regional specialist companies in the EU will expand the potential of the short- and rapid-acting market in this region beyond that achieved by Cephalon to date. Experienced local speciality companies such as Meda, Nycomed (Instanyl), and ProStrakan will provide significantly more competition to Cephalon in Europe than in the U.S., fragmenting the European market; Datamonitor forecasts that the 5EU (France, Germany, Italy, Spain, and the U.K.) market will grow from around $80 million in 2008 to $402 million in 2018.

Market Saturation

Serving a clear unmet need, the short- and rapid-acting opioids market is set to grow considerably over the next 10 years. Sales in the seven major pharmaceutical markets (U.S., Japan, and the 5EU) are set to reach $1.7 billion in 2018. Regionally strong marketing companies and diverse delivery technologies will help drive sales in both cancer and noncancer breakthrough pain. With a large number of short- and rapid-acting opioids in Phase III and Phase II development (over a dozen), saturation will limit the commercial potential of individual brands over the coming years.

Terence McManus, Ph.D. ([email protected]), is a CNS senior

analyst at Datamonitor. Web: www.datamonitor.com.