July 1, 2013 (Vol. 33, No. 13)

Faced with shrinking budgets and rising costs, organizations are increasingly looking to enhance operational efficiency. Often this includes improving management of laboratory assets, like instruments and IT.

Keeping track of preventive maintenance schedules, repairs, compliance issues, and instrument life cycles can be overwhelming when multiple sites and vendors are involved. Another issue is upkeep of facilities or appropriately purchasing needed real estate.

Managing the many needs of a facility also can be all-consuming. While a number of big pharma companies already outsource asset management, the field is seeing a new trend of small and mid-sized organizations entering this market.

A laboratory’s instruments are capital assets. Their efficient use, maintenance, and—when appropriate—replacement are strategic decisions that impact lab productivity and cost management, according to Gary Grecsek, vp, PerkinElmer OneSource Laboratory Services.

“Asset management is an evolving scene. One focus continues to be a multivendor service model that consolidates service for all instruments in the lab. Utilizing one vendor instead of multiple vendors can provide significant service improvements as well as measurable cost savings,” Grecsek says. “Advantages to a laboratory include assessments for if instruments are efficiently or inefficiently utilized, determinations for how quickly repairs can be anticipated, and tracking of necessary compliance programs.”

According to Grecsek, the overall goal of OneSource is to simplify. “Enhancing productivity is the most important goal for most laboratories. Until recently, many laboratories relied on the original equipment manufacturer for repairs. This is a fragmented and inefficient process with key issues of downtime and response time. We implement a systematic approach so laboratories wouldn’t have to chase down a multitude of vendors,” he says.

Another pressing need is for IT consolidation and consulting. “With the ever-increasing complexity of software programs, often scientists find they are spending lots of time trying to fix, modify, support, or adapt programs for their needs,” Grecsek says.

Managing Life Cycles

Historically, laboratory managers would purchase scientific instruments and then use them until age and/or disrepair rendered them useless.

“Forward-thinking laboratory managers, however, use laboratory asset management programs and effective technology life-cycle strategies to optimize their laboratory infrastructures,” says Michael Pope, worldwide business unit manager, service and support division, Agilent Technologies.

Pope’s firm provides asset management services that chart instrument age, function, criticality, and annual failure rate in order to optimize equipment use and better assess life-cycle decisions.

“We began getting into the field of asset management five to seven years ago because we recognized the need for managers and chemists to better handle business decisions related to their laboratories,” Pope says. “We wanted to bring business solutions into the lab that enhanced workflow and not merely be an equipment provider/servicer.”

While big pharma is a frequent customer, the company is now seeing more business from academia and nonprofit research institutions. Pope cites the example of St. Jude Children’s Research Hospital.

“St. Jude’s has lots of assets. The question was how could they get their arms around and better manage their assets. They came to us, and we helped to provide the infrastructure to do that,” he says.

In the race for funding, even academia must carefully consider how not to lose new opportunities by utilizing older technology that could jeopardize future funding. Pope notes that the life cycle for typical instrumentation “used to be about seven to fifteen years. Now, it can be three to seven years or even one to two years for newer, cutting-edge technology.”

“We’ve looked about one to three years in the future and see even mid-tier organizations becoming interested in asset management,” he adds. “Regardless of whether you are big pharma or a smaller research lab, working from a more holistic view of equipment and asset management is a trend that is here to stay.”

Mobile Technology

Smart phones and tablets are now being used in laboratory asset management. For example, GE Healthcare Life Sciences’ ASSETscan™ enables wireless access for instantly connecting with a detailed instrumentation database. “By tagging a client’s instruments with a quick response (QR) code or a standard barcode, all details desired can be entered into a database for immediate access, even by a cell phones or iPads,” says Matt Sawtell, director, global advisory services.

Implementing a coding system and even developing custom apps is increasingly finding its way into the laboratory setting for more efficient and instant access to data on a broad portfolio of assets that includes physical inventories, IT assets, consumables, and even finances.

“This type of monitoring also can facilitate mergers and acquisitions (M&A) by allowing managers to easily analyze their inventories prior to laboratory moves,” Sawtell says. “In a recent survey by GE Healthcare, over 90% of pharma executives reported expecting M&A activity to impact their organization in the next three years.”

He adds that “asset management is one of the key issues during M&A. An efficient, data-driven approach is clearly a way to enhance productivity during this time. It provides cost savings, shortens equipment downtime, and can help communication among key personnel in the merging companies.”

GE Healthcare offers customers a Laboratory Asset Management Assessment (LAMA) program. “The process involves developing a thorough understanding of the scope of the project, communicating with key personnel who rely on the service model, conducting a physical inventory that includes tagging equipment, and then creating final reports,” Sawtell says.

According to Sawtell, current economic pressures are forcing more and more companies to think differently about how to save time and money and improve productivity. “We are now seeing an industry trend to have such programs as LAMA filter from big pharma into mid-sized companies and even academia,” he says. “The desire is to allow their core of scientists to devote more time to research by outsourcing asset management to experts in the field.”

Saving Money

In 2011, Thermo Fisher Scientific took the step to reorganize a large portion of its long-standing, instrument-centric service organizations under a new structure known as Unity™ Lab Services. This new organization combines the firm’s expertise in laboratory support services into a single solution to optimize productivity and reduce the total costs for laboratory operations.

How much can one expect to save by streamlining services utilizing their asset management program? The company says typical first year savings should average 10% or greater, with additional savings in subsequent years as customer programs expand.

“One of the biggest challenges that Unity Asset Management Services helps clients resolve is streamlining asset maintenance to drive efficiencies, increase uptime, and decrease inventory costs,” says Keith Martinko, global product development manager, Unity Lab Services.

Pointing to how outsourcing asset management played out in the real world, he adds: “One of our Unity Lab Services clients—a large pharmaceutical company—was faced with the challenge of migrating service managed by individual researchers on more than 2,500 instruments at three individual geographic sites into an integrated asset management solution. Their goals were to collect and maintain an accurate instrument inventory, establish a single point of contact for all service management to deliver improved service quality, and provide performance metrics that could be used to monitor performance and drive cost savings.”

Unity Lab Services implemented a custom solution. The program consisted of dedicated onsite service engineers and site managers who managed day-to-day operations and utilized a centralized call center that streamlined operations and PM scheduling, which allowed for the delivery of planned services and improved uptime. This client also gained online access to all maintenance activity, and executed more informed decision making through leveraging detailed business reports. Ultimately, this customized solution resulted in savings of more than $2.2 million with faster service response, increased uptime, and improved laboratory productivity.

“Saving time and money via outsourcing asset management is something that is here to stay,” adds Rodney Smith, president, Unity Lab Services. “Innovations in technology, such as asset utilization monitoring and comprehensive data mining, will deliver the expanded knowledge that laboratories need to drive proactive services, and improve researcher productivity and instrument uptime.”

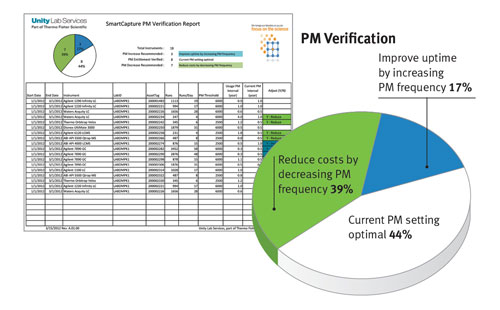

According to Thermo Fisher Scientific, its SmartCapture system provides knowledge of asset utilization and the power to make informed lab productivity decisions.

Managing Real Estate

No longer does the life science industry often hold on to large tracts of land for future development, notes Richard McBlaine, international director, life sciences, Jones Lang LaSalle (JLL).

“Because of the economy as well as patent cliffs, most of the industry is no longer banking real estate. Now companies primarily are right-sizing and leasing or acquiring only the facilities they immediately need,” McBlaine says. “Some of the challenges faced in managing these facilities include hazardous waste management, roof maintenance, landscaping, snow removal, security, and even window washing, et cetera. Increasingly, companies are outsourcing these duties so they can focus on their core missions.”

JLL’s life sciences business manages 70 million square feet of research, manufacturing, and commercial space for some of the largest life sciences companies in the world, providing integrated facilities management, engineering and operations, energy and sustainability, transaction advisory services, lease administration, project management, and laboratory management services.

According to McBlaine, outsourcing to an expert facilities team specializing in life sciences is important because “these facilities often have special needs, for example, hazmat or research materials and equipment that are very sensitive to vibrations, heat/cold, humidity, et cetera. Choosing an experienced partner to do this assures everything is done safely and efficiently.”

He adds that another advantage to outsourcing is the ability to save on energy costs through use reduction and price negotiation. “Utilizing best practices and centralized purchasing, both the cost of power and the amount of energy utilized can be significantly reduced,” McBlaine says. “Including the latest smart building technology and service platforms helps ensure that each building is operating at peak efficiency.”

When looking into acquiring or leasing facilities for R&D and other operations, a new trend among life sciences companies is to cluster where prospective employees live.

“Years ago, the norm was for workers to relocate to get a job. Now, younger workers place more of a priority on choosing where they want to live, according to the quality of life they want to have. Thus, companies are increasingly seeking locations with access to the best pools of expert workers,” McBlaine says. “Places such as San Diego, Greater Boston, Philadelphia, Raleigh-Durham, and San Francisco are among the locations that companies are now selecting. For life sciences companies, managing their corporate real estate portfolios now requires not only expertise in the unique aspects of their facilities, but also an understanding of site selection dynamics in light of these clusters—establishing locations where talent, funding, and facilities are available for life science needs.”