Pfizer has agreed to acquire Arena Pharmaceuticals for approximately $6.7 billion, the companies said today, in a deal designed to expand the buyer’s immuno-inflammatory disease pipeline, led by Arena’s Phase II/II lead candidate etrasimod.

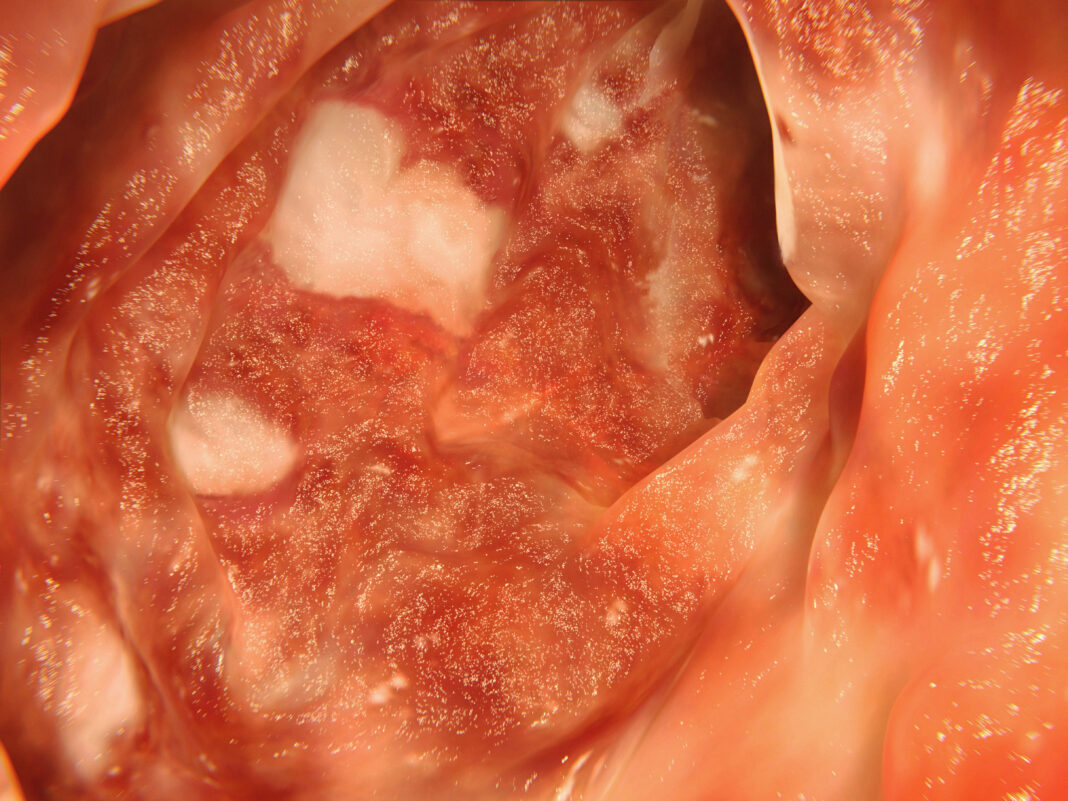

Etrasimod is an oral, selective sphingosine 1-phosphate (S1P) receptor modulator under study for a range of immuno-inflammatory diseases—notably moderately to severely active ulcerative colitis (UC), for which the drug is in two pivotal Phase III trials:

- ELEVATE UC 12 (NCT03996369), designed to assess the safety and efficacy of etrasimod on clinical remission at 12 weeks following treatment with etrasimod, as assessed by the FDA-required, 3-domain, modified Mayo Score.

- ELEVATE UC 52 (NCT03945188), a one-year trial designed to evaluate clinical remission at 12 weeks, or induction, and at 52 weeks, following treatment with etrasimod.

Data from both ELEVATE studies is expected to be read out in 2022, Arena and Pfizer said.

“Utilizing Pfizer’s leading research and global development capabilities, we plan to accelerate the clinical development of etrasimod for patients with immuno-inflammatory diseases,” Mike Gladstone, global president & general manager, Pfizer Inflammation and Immunology, said in a statement. “The proposed acquisition of Arena complements our capabilities and expertise in inflammation and immunology, a Pfizer innovation engine developing potential therapies for patients with debilitating immuno-inflammatory diseases with a need for more effective treatment options.”

Investors roared their approval of the Pfizer deal today, sending Arema’s shares rocketing about 83% as of 12:01 p.m., to $91.31 from Friday’s close of $49.94. Shares of Pfizer rose 5%, to $55.55 from Friday’s close of $52.78.

Arena reported positive data in 2018 from the 156-patient Phase II OASIS study showing etrasimod to have led to statistically significant improvements versus placebo in the primary, all secondary, and clinical remission endpoints. Most patients who achieved clinical response, clinical remission, or endoscopic improvement at week 12 experienced sustained or improved effects up to week 46 with etrasimod 2 mg in an open-label extension.

Earlier this year, when 52 weeks of data was assessed from 118 patients in the long-term study, 64% of patients met the criteria for clinical response, 33% for clinical remission, and 43% for endoscopic improvement. Week 12 clinical response, clinical remission, or endoscopic improvement was maintained to end of treatment in 85%, 60%, or 69% of patients, respectively, according to a study published January 21 in Journal of Crohn’s and Colitis.

Head-to-head with BMS

In acquiring Arena, Pfizer hopes to go head-to-head with Bristol-Myers Squibb’s Zeposia® (ozanimod), first approved in 2020 for relapsing forms of multiple sclerosis. On May 27, Zeposia won FDA approval as the first and to-date only S1P receptor modulator approved for treating moderately to severely active UC. Zeposia generated $40 million in product revenue during the third quarter (up from $2 million in Q3 2020) and $86 million during the first three quarters of 2021 (up from $3 million a year earlier).

“We believe ARNA’s lead asset, etrasimod, is partially de-risked given the positive read through from Bristol-Myers Squibb’s ozanimod (Zeposia), combined with the positive Ph.2 OASIS data in ulcerative colitis,” Joseph P. Schwartz, managing director, rare diseases, and a senior research analyst with SVB Leerink, wrote today in a research note.

“We view PFE as a logical partner for ARNA as the latter continues to progress its gastroenterology, dermatology, and cardiology focused platform, which should benefit from the executional expertise of a large pharmaceutical company,” Schwartz commented.

Etrasimod is also under study for ulcerative colitis in the Phase II GLADIATOR trial (NCT04607837)—as well as in Crohn’s disease through the Phase II/III CULTIVATE trial (NCT04173273), and in eosinophilic esophagitis through the Phase II VOYAGE trial (NCT04682639). Arena is planning a Phase III study of etrasimod called ADVISE focused on atopic dermatitis following completion of a Phase II trial of the same name (NCT04162769), as well as a Phase III trial of the drug in alopecia areata.

Also in Arena’s pipeline are two internally developed clinical-stage cardiovascular assets. One is Temanogrel, a peripherally acting, and selective 5-HT2A receptor inverse agonist designed to inhibit serotonin (5-HT)-mediated amplification of platelet aggregation and vasoconstriction Temanogrel is in Phase II for the treatment of microvascular obstruction and Raynaud’s phenomenon secondary to systemic sclerosis.

The other internal pipeline candidate is APD418, a potentially first-in-class, investigational, β3-adrenergic receptor (AdrR) antagonist and cardiac myotrope for acute heart failure. APD418 is a selective antagonist designed to improve cardiac contractility with minimal effect on heart rate and blood pressure. Arena reasons that inhibition of β3-AdrR–mediated myofilament repression may provide a cardiomyocyte-specific target to enhance cardiac contractile performance. APD418 is in a Phase II study in acute heart failure.

Beyond APD418 and Temanogrel, Arena’s pipeline includes an up-to-$70 million collaboration with Aristea Therapeutics to develop its lead candidate RIST4721 in two dermatology indications: palmoplantar pustulosis, for which a Phase IIb trial is being planned, as well as for hidradenitis suppurativa, now in exploratory stages according to Arena.

Arena has its principal executive offices in Park City, UT, with most U.S. operations in San Diego and an office in Boston—as well as some operations in Zug, Switzerland.

Pfizer agreed to acquire all outstanding shares of Arena common stock for $100 per share in cash—more than double Friday’s closing stock price. The proposed transaction is subject to customary closing conditions, including receipt of regulatory approvals and approval by Arena’s stockholders.

“Pfizer’s capabilities will accelerate our mission to deliver our important medicines to patients,” added Amit D. Munshi, Arena’s president and CEO. “We believe this transaction represents the best next step for both patients and shareholders.”