Lost in all the talk about biotech stocks falling since the markets turned bearish two years ago is that overall, they have performed better than the market as a whole.

Many biotech stocks sank deeper than the overall market during the first quarter, as GEN recently reported. But the first quarter (Q1) results were skewed by the banking crisis wrought by the collapses of Silicon Valley Bank and Signature Bank. Since then, shares of publicly traded biotechs have either been climbing or have slipping by smaller degrees than a year ago,

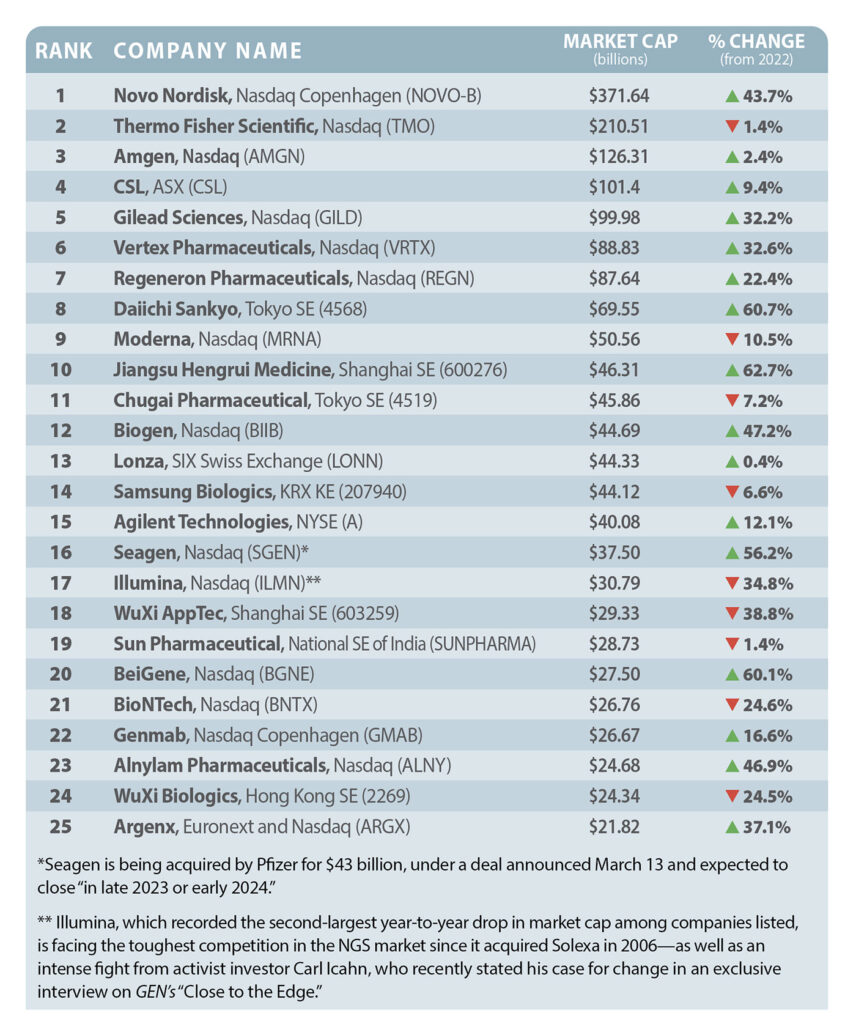

This year’s winners are led by Jiangsu Hengrui, which vaulted from No. 15 to No. 10 by showing the largest year-over-year market cap gain at 62.7%, thanks to positive clinical data for its camrelizumab (such as a Phase III trial with Elavar Therapeutics’ rivoceranib in liver cancer) and deals (licensing the peripheral T-cell lymphoma candidate SHR-2554 to Treeline Biosciences for $706 million). Next highest at 60.7% is a company that didn’t even make GEN’s A-List last year, Daiichi Sankyo, following new approvals and a pivot to oncology anchored by Enhertu® (fam-trastuzumab deruxtecan-nxki), co-marketed with AstraZeneca.

Daiichi Sankyo is one of three companies on this year’s top 25 whose market caps were not large enough to appear on the list last year. One of the other companies is argenx, an immunology-focused drug developer focused on treating severe autoimmune diseases. Its 37.1% jump in market cap catapulted the company to No. 25 this year. The other newcomer is BeiGene, whose antibody-based pipeline could, according to the company, address 80% of the world’s cancers by cancer type.

A spot check by GEN reveals that six of the top 10 electronic transfer funds (ETFs) reporting year-over-year gains as of May 2, compared with eight of the 10 showing one-year losses at the end of Q1. The biggest one-year gainer (up 10.1%) was First Trust NYSE Arca Biotech ETF (FBT), the fourth largest ETF with $1.46 billion in total assets, jumping from $138.38 to $152.29.

By comparison, the overall Standard & Poor’s (S&P) 500 index, which tracks 500 of the largest U.S. public stocks, dipped 0.9% from May 2, 2022 through the same date this year, from $4,155.38 to $4,119.58.

The biggest one-year decliner (down 40.2%) was Direxion Daily S&P Biotech Bull 3X Shares (LABU), the fifth-largest ETF with about $1.064 billion in total assets (dropping from $9.14 to $5.47). Yet since March 31, LABU’s price has risen 11.4%, climbing from $4.91, while FBT dipped 1.8% (from $155.03) and the S&P 500 inched up 0.2% from $4,109.31.

The largest biotech ETF with $7.93 billion in total assets, the iShares Biotechnology ETF (IBB), rose 9.7% year-over-year, from $118.36 to $129.81, but only 0.5% since March 31. The second-ranked ETF, PDR S&P Biotech ETF (XBI; $6.447 billion), increased 3.8% since May 2, 2022 but 4.6% since March 31. Third-ranked ARK Genomic Revolution ETF ($1.865 billion) skidded 21%, from $35.76 to $28.26—but has only decreased 6% since March 31.

Total asset figures were supplied by VettaFi, a provider of ETF and other data, analytics, and thought leadership for asset managers.

Making the List

This A-List presents GEN’s updated list of the top 25 biotech companies, ranked by their market capitalization (the product of the share price and the number of outstanding shares) as of May 2, 2023—as indicated by the exchanges on which the companies’ shares are traded, or by other publicly available sources. Each company is listed by rank, name, market cap in billions of dollars, and percentage change from last year. (Figures are rounded off to the nearest hundredth.)

This list does not include pharmaceutical companies with a heritage of small-molecule, non-biologic drug development, which GEN has covered in recent years through a separate list.

The total market capitalization of the 25 biotech firms on this list rose about 17% from GEN’s 2022 A-List, from $1.498 trillion to $1.75 trillion. Over the past five years, market cap for the top 25 biotechs has more than doubled (up 190%) from the $918.85 billion reported by GEN’s “Top 25 Biotech Companies of 2018.”

Going back to 2018, 10 top biotechs that were listed back then do not appear here—either because they were acquired, or because their market caps didn’t keep pace with this year’s top 25.

Among this year’s top 25 biotech companies, gainers of market cap (16) outnumbered losers (9)—compared with 14 and 11 last year.

Companies headquartered outside the United States accounted for more than half (14) of the companies ranked on this year’s top 25 list biotech companies, one more than on GEN’s 2022 A-List, though two ex-U.S. companies that made this year’s list did not appear last year.

Of the 14 headquartered outside the United States, four are based in China, two in Denmark and Japan, and one each in Australia, Germany, India, the Netherlands, South Korea, and Switzerland (but not including a second company with a Swiss headquarters since it also maintains headquarters in the United States).

The smallest company listed this year has a market cap of just under $16 billion, compared with just over $14 billion for the 25th ranked company on GEN’s 2022 list.

Just missing the list at number 26 is Otsuka Holdings, which had a market cap of $19.70 billion on May 2, followed by Celltrion ($18.55 billion), UCB (which made last year’s list but has since fallen 17%, to an even $18 billion), BioMarin Pharmaceutical ($17.61 billion), and Incyte ($15.60 billion).