AstraZeneca has agreed to develop Daiichi Sankyo’s Phase I cancer antibody drug conjugate (ADC) DS-1062 worldwide except Japan, through a collaboration that the Japanese pharma said today could generate for it up to $6 billion—of which $1 billion will be paid within two years.

DS-1062 is a trophoblast cell-surface antigen 2 (TROP2)-directed ADC that is now in Phase I clinical development for non-small cell lung cancer (NSCLC) and triple negative breast cancer (TNBC).

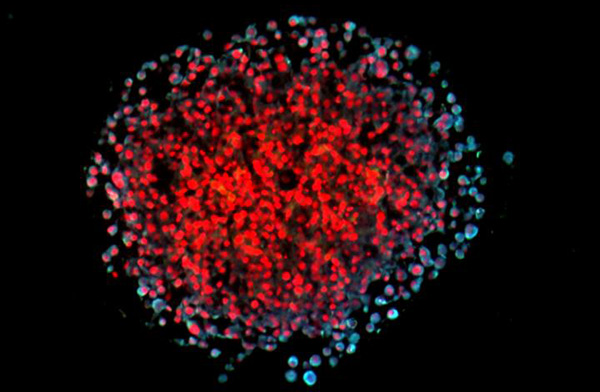

Designed using Daiichi Sankyo’s proprietary DXd ADC technology, DS-1062 consists of a humanized anti-TROP2 monoclonal antibody attached to a topoisomerase I inhibitor payload by a tetrapeptide-based linker with a customized drug-to-antibody ratio (DAR) of four to optimize the benefit-risk ratio for the intended patient population.

DS-1062 will not be the first drug targeting TROP2 to win FDA approval. Immunomedics earned that distinction in April, when the agency authorized its lead ADC Trodelvy™ (sacituzumab govitecan-hziy) as a treatment for adults with metastatic TNBC who have received at least two prior therapies for metastatic disease. Trodelvy is the first ADC approved by the FDA specifically for relapsed or refractory metastatic TNBC, and is also the first FDA-approved anti-Trop-2 ADC. The first revenue data on Trodelvy could emerge when Immunomedics reports second-quarter results on August 5.

DS-1062 is now under study in a Phase I trial (NCT03401385) now enrolling patients with advanced solid tumors that are refractory to or relapsed from standard treatment or for whom no standard treatment is available. Daiichi Sankyo has estimated that about 350 patients with unresectable advanced NSCLC and unresectable/advanced or metastatic TNBC will be enrolled in the trial, which has an estimated primary completion date of January 1, 2022.

At the virtual 2020 American Society of Clinical Oncology (ASCO) Annual Meeting in May, Daiichi Sankyo presented updated DS-1062 data showing a 27% (23/85) response rate in unselected TROP2 expression in last line therapy post platinum and checkpoint inhibitor in NSCLC. The 23 responders showed durable responses, with three patients lasting beyond 12 months.

ILD data “worth watching”

However, the data also showed what one set of analysts said was potential cause for concern: Eight (5.8%) occurrences of drug-related interstitial lung disease (ILD) with two deemed Grade 5, one Grade 3, four Grade 2 and one Grade 1.

“We believe DS-1062’s more potent payload along with more stable linker versus Trodelvy could enable the best-in-class potential, although the ILD noted could be a liability for the asset and is worth watching,” Andrew Berens, MD, managing director, targeted oncology with SVB Leerink, and two colleagues, said in an investor note.

“In our view, this strategic collaboration could accelerate DS-1062’s clinical development in lung cancer and TNBC, with upside potential in multiple other solid tumors,” Berens and colleagues added.

Daiichi Sankyo cites preclinical studies that have shown DS-1062 to selectively bind to the TROP2 receptor on the surface of a tumor cell. The company reasons that DS-1062 is then internalized into the cancer cell where lysosomal enzymes break down the tetrapeptide-based linker and release the DXd payload.

“DS-1062, one of our lead DXd ADCs that will form a pillar of our next mid-term business plan, has the potential to become a best-in-class TROP2 ADC in multiple tumors, including lung and breast cancers,” Sunao Manabe, representative director, president and CEO of Daiichi Sankyo, said in a statement. “This new strategic collaboration with AstraZeneca, a company with extensive experience and significant expertise in the global oncology business, will enable us to deliver DS-1062 to more patients around the world as quickly as possible.”

Oncology is one of Daiichi Sankyo’s primary focus areas of research, along with pain, central nervous system (CNS) disease, heart and kidney disease, rare diseases, and immune disorders.

Second collaboration

The collaboration is the second between AstraZeneca and Daiichi Sankyo. The first was launched last year, when the U.K.-based pharma giant committed up to $6.9 billion toward developing and commercializing another Daiichi Sankyo ADC, ENHERTU® (trastuzumab deruxtecan except in the U.S., where the generic name is fam-trastuzumab deruxtecan-nxki). The HER2-directed antibody and topoisomerase inhibitor conjugate was approved by the FDA last year for the treatment of adults with unresectable or metastatic HER2-positive breast cancer who have received two or more prior anti-HER2-based regimens in the metastatic setting.

“We are delighted to enter this new collaboration with Daiichi Sankyo and to build on the successful launch of ENHERTU to further expand our pipeline and leadership in oncology. We now have six potential blockbusters in oncology with more to come in our early and late pipelines,” stated AstraZeneca CEO Pascal Soriot.

As for DS-1062, Soriot added: “We see significant potential in this antibody drug conjugate in lung as well as in breast and other cancers that commonly express TROP2.”

Immunomedics also continues to see added potential for its TROP2-targeting drug. Earlier this month, it announced positive Phase III results for Trodelvy, saying the drug met its primary endpoint of progression-free survival (PFS), and key secondary endpoints in brain metastasis negative patients with mTNBC who previously received at least two prior therapies for metastatic disease. A supplemental BLA submission is planned later this year.

“As we have done with ENHERTU, we will jointly design and implement strategies to maximize the value of DS-1062,” Manabe added.

Cost sharing

Daiichi Sankyo and AstraZeneca have agreed to share equally development and commercialization costs as well as profits from DS-1062 worldwide—except in Japan, where Daiichi Sankyo will maintain exclusive rights.

AstraZeneca agreed to pay Daiichi Sankyo $1 billion upfront, consisting of $350 million due upon execution of the agreement, $325 million to be paid after 12 months, and another $325 million due after 24 months. AstraZeneca also agreed to pay Daiichi Sankyo up to $5 billion tied to achieving milestones—to consist of up to $1 billion for regulatory milestones, and up to $4 billion for sales-related milestones.

AstraZeneca said the collaboration will not affect its financial guidance for 2020. In releasing first-quarter results on April 29, AstraZeneca said it still expected its total revenue to increase by a high single-digit to a low double-digit percentage, with core earnings per share projected to increase by a mid- to high-teens percentage.

Daiichi Sankyo said the collaboration will add to corporate and shareholder value “over the mid- to long-term,” adding that it will announce the collaboration’s impact on its consolidated financials for its current fiscal year, which ends March 31, 2021, “at an appropriate time in the future.”

Under their deal, AstraZeneca is expected to book sales in global markets that include China, Australia, Canada, and Russia—while Daiichi Sankyo is expected to book sales in the U.S., certain European countries, and other markets where the company has affiliates.