Emil Salazar Anal Kalorama Information

Market recovery will depend on the contributions of diagnostic testing segments.

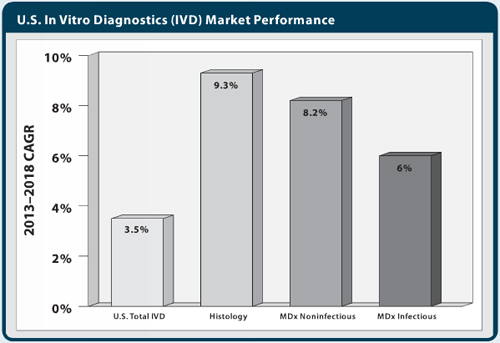

There’s reason to be both optimistic and pessimistic about the United States IVD market, depending on what sectors one wishes to focus on. Despite persistent challenges to the U.S. in vitro diagnostics (IVD) market, advanced testing segments can lead a bounce-back delivering growth to test innovators—suppliers and labs alike. Chief among recent disappointments in U.S. IVD market performance has been the disruption of histology and molecular markets, previous mainstays of high revenue growth. Recovery in the U.S. IVD market will depend in large part on the contributions of histology and molecular diagnostic testing segments, which are projected to grow by an average of 7.5% per year through 2018. Market expansion for these advanced diagnostics segments will be a result of test introduction and the stabilization of coverage, reimbursement decisions, and procedures on the part of payers.

Including histopathology and cytology, the histology market segment has been driven by its primary application in oncology and the increasingly common application of complex molecular techniques. Fluorescent in situ hybridization (FISH) and a growing population of cancer patients linked to demographic aging have increased the number of histology analyses performed. Histology procedures, particularly immunohistochemical and molecular ISH tests, saw such a rapid uptick in clinical demand—from approximately 1 million to 4.6 million and 3,000 to 1.2 million procedures respectively between 2000 and 2010 under Medicare Part B—that CMS cut office reimbursements and billing procedures during 2011–2013. Many private payers have followed suit.

Reimbursement cuts have been devastating to smaller pathology labs and practices and have stalled the U.S. histology market. Future market-based reimbursement schedules introduced for Medicare will steer more business to reference and other large labs, shrinking the lab client base, but should also lend some market stability for procedure volumes to grow and for histology automation investment to continue. Market-based fee schedules should also discontinue the year-to-year volatility in reimbursement amounts provided for pathology procedures. Coupled with the market driver of demographic aging, stabilization in the lab industry should allow the U.S. histology market to recover—projected by Kalorama Information (KI) to average 9% growth annually in the 2013–2018 period.

Both primary segments of the U.S. molecular assays market—noninfectious and infectious disease tests—are projected to lead the U.S. IVD market behind histology. Molecular noninfectious disease testing includes high-growth, emerging assays used to detect cancer markers in blood; circulating tumor cells (CTCs); screen for hereditary diseases; and pharmacodiagnostic markers useful in personalized medicine.

Similar to histology, molecular noninfectious disease testing has grown in conjunction with the development of advanced cancer therapies. Hereditary disease screening includes molecular testing for genetic risk factors, notably the BRCA gene that raises a patient’s risk of breast cancer. Blood-based cancer markers and CTC tests are seeing use in the early detection of cancers, including recurrence, and to monitor remission. Current pharmacodiagnostics (PGx) testing includes EGR and associated gene mutations, HER, and BCR/ABL. Further innovation in PGx is being driven by sequencing—patients at top-tier cancer centers are already benefiting from lab-developed tests (LDTs), while more genetic markers are under development through sequencing and trials to become commercialized assays.

Recent market growth for molecular noninfectious disease tests was halted in recent years by the introduction of new molecular CPT codes, and inconsistent, or in some cases severely diminished reimbursement or coverage by regional MACs. In 2013, the molecular noninfectious IVD segment was estimated by Kalorama Information to have grown less than 4%. Again, CMS reforms to molecular test scheduling and fee setting represent the linchpin for the future success of the U.S. molecular non-infectious segment. Seeking to improve upon its botched roll-out of new molecular codes, CMS in the recently passed “Doc Fix” Act (H.R. 4032; April 2014) is obligated to standardize coding procedures for new tests with the assistance of an expert advisory panel.

Proprietary molecular noninfectious tests, largely multi-analyte algorithm-based assays and other LDTs, were singled out in the “Doc Fix” Act for provisionary list prices and a grace period before market adjustment. Expanding use of molecular diagnostics in personalized medicine, along with beneficial reform led by CMS, is expected to restore growth in the U.S. market for molecular noninfectious disease tests to approximately 8% annually through 2018.

The molecular infectious disease testing market has enjoyed consistent above-average growth in the U.S. IVD market through industry response and cycling through emergent pathogens and threats. Today’s market now features a CLIA-waived and home-use approved HIV test kit. Innovators such as Cepheid, BioFire Diagnostics (bioMerieux), IQuum (Roche), Quidel, and Nanosphere offer moderate-complexity, rapid molecular testing platforms that now see well-founded consideration for CLIA waivers.

Healthcare-acquired infection testing platforms continue to see placements among U.S. hospitals; vendors are busy developing multiplexed tests for the characterization and identification of urinary tract infection and respiratory pathogens, influenza strains, sexually transmitted diseases, and fungal infections. The expanded use of molecular testing for infectious diseases outside of the centralized lab and more sophisticated molecular screening now entering point-of-care and hospital lab settings is expected to drive segment growth. Through 2018, the U.S. molecular infectious disease IVD market is projected by KI to average 6% annually.

Emil Salazar is an analyst at Kalorama Information. More information on this report can be found at www.kaloramainformation.com.

This article was originally published in the August 13 issue of Clinical OMICs. For more content like this and details on how to get a free subscription to this new digital publication, go to www.clinicalomics.com.