February 15, 2011 (Vol. 31, No. 4)

Sector Includes Sample and Library Prep Kits, Reagents, and Other Consumables

The DNA sequencer market has undergone rapid changes in the last few years, unlike any period in its history and also unique relative to most technologies except the computer or the chip. Sales of next-generation systems have been growing; in fact, Kalorama Information’s research has found that most labs performing sequencing own a next-gen system.

The process of DNA sequencing, and thus the market for sequencing products, involves more than just the sequencers themselves. Sequencing is a multistep process that involves the preparation of samples and target-enrichment systems. The fragmentation and library steps alone can take anywhere from two to six hours, and a poor sample library prep protocol can cause bottlenecks in the lab.

DNA sequencing is also an area where labs may seek to reduce costs. This is an opportunity that a few vendors are taking advantage of by making off-brand sales to labs that own other companies’ sequencers. And according to our research, labs are receptive.

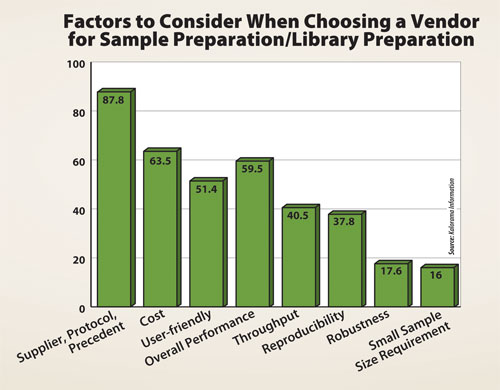

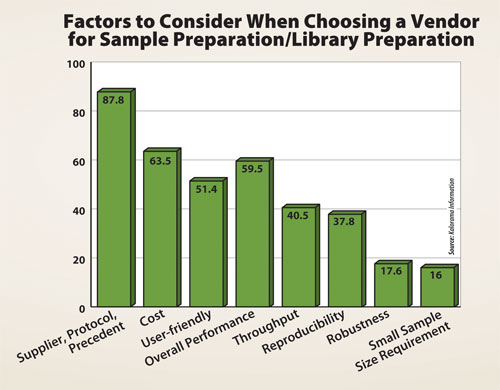

Last year, Kalorama Information conducted a survey of next-generation sequencing labs with the aim of obtaining a demand-side view of some of the key changes taking place with both next-generation and capillary sequencers (with a focus on next-gen).

We asked labs about the sequencers they own and plan to purchase, and also focused on the steps that surround the sequencing process—sample and library preparation kits, reagents, and other consumables used for sequencing.

We spoke to 120 labs, most in academia, medical centers, or related types of labs. The labs, on average, owned three sequencers from a variety of different vendors.

The increasing importance of second- and third-generation systems was obvious in the results. Approximately 80% of the laboratories had a next-generation sequencer which was running most of the time, however close to one-third of the systems in use were capillary systems.

When respondents were asked which applications were most likely to increase between 2010 and 2012, the overwhelming response was resequencing.

There are some areas of the DNA sequencing process where it was clear that one vendor had a clear hold on the market. Target enrichment, which can improve the sequencing process by allowing researchers to sequence exact sections of the genome, was one of those areas. Other areas of sequencing demonstrated more robust competition, including DNA and RNA fragmentation. In terms of library preparation, there was even greater off-protocol usage.

Overall, Kalorama estimates that about 76% of product usage is with the vendor-recommended protocols. A good percentage of labs, especially those at academic centers, use home-brew library-prep solutions. We think that usage will be fairly consistent, though it may drop some if off-protocol solutions become more attractive.

Many labs indicated that while they utilized vendor-recommended protocols, they were experimenting with other products. We believe that by 2013, there will be a shift in off-protocol sample/library prep usage where a good number, perhaps as high as 22% of labs, will go off vendor protocols. These estimates are not part of the survey report, but have been compiled for GEN based on analysis of existing data and comments from labs.

As more demands are made on labs, the capacity of sequencers will need to be matched by improvements in sample- and library-prep systems. Running more samples means it takes more time to do sample prep. As one lab director told us: “We need more people, or a robot, or some way that makes it easier.”

Bruce Carlson ([email protected]) is publisher at Kalorama Information. The “Sample Preparation and Library Preparation for DNA Sequencers” survey can be found at www.kaloramainformation.com.