May 15, 2011 (Vol. 31, No. 10)

Biotech Companies Outsource 81% of Their Requirements to Contract Manufacturers

The development of genetically engineered drugs is a relatively new endeavor. Insulin, as Humulin® from Eli Lilly & Co. and approved in 1982, was the first genetically engineered biopharmaceutical. Although biopharmaceutical discovery and development are relatively new, these drugs comprise 10% of all pharmaceuticals today and represent the fastest growing sector of pharmaceutical production.

Biopharmaceuticals are manufactured both by companies with internal capacity and by contract manufacturers that provide manufacturing expertise and capacity. HighTech Business Decisions’ recent report, Biopharmaceutical Fill-and-Finish: Best Practices Study, reviews the operational and business activities related to contract manufacturing of finished biopharmaceuticals.

The summary information presented in this article is based on extensive interviews with 29 directors of biomanufacturing at pharmaceutical companies and executives from 12 fill-and-finish contract manufacturing organizations (CMOs). This article highlights the current state of the outsource market for fill-and-finish services, contractor fill-and-finish capacity and capabilities, and future trends for the CMO industry.

Outsourcing

Generally, companies outsource their biopharmaceutical fill-and-finish needs to take advantage of the CMO’s expertise and specialized manufacturing capabilities. On average, biotech companies outsource 81% of their fill-and-finish requirements. While this is an average, the industry’s fill-and-finish outsourcing requirements vary considerably among biotechnology companies. Biotechnology and pharmaceutical companies with in-house fill-and-finish capabilities outsource 40% of their requirements. On the other hand, many smaller biotechnology companies with no in-house biologic fill-and-finish capabilities outsource 100% of their requirements.

The biotech companies that outsource 100% of their biologic fill-and-finish needs tend to be smaller companies with biologics in early-phase clinical trials. A majority (63%) of these companies have no plans to change the way they outsource their fill-and-finish requirements. According to one director when asked about his plans to continue to outsource his fill-and-finish requirements, “From what I’ve seen, unless you have many products, fill-and-finish is an underutilized function at biotechnology companies.”

Conversely, 37% of the companies that outsource all their fill-and-finish needs plan to either switch CMOs or build in-house capabilities. The major reasons for switching CMOs are the company’s need for improved capacity or capability.

The other segment of this market is biotechnology and pharmaceutical companies with in-house biopharmaceutical fill-and-finish capacity that also use CMOs for some of their fill-and-finish needs. These companies outsource to CMOs primarily to gain access to capacity or to gain access to specialized technology. Examples of the types of capacity that these biotechnology companies need include: a) temporary capacity during start up of in-house capacity, b) balancing production volumes to line capacities, or c) manufacturing that is validated for commercial products.

As mentioned previously, companies with in-house fill-and-finish capacity will use a CMO to gain access to specialized technology. Some examples of specialized technology required by biotechnology companies include the need for barrier isolation for handling cytotoxic material or lyophilizers for freeze-drying and stabilizing their drug product. As noted by one of the manufacturing directors, “Anytime we need to add production and reduce capital spending we consider outsourcing. Fill-and-finish production is not our core competency. When we need special services like handling cytotoxics or blow fill seals, we look to contractors.”

Capacity

Few biopharmaceuticals are orally available; biologics are typically formulated and aseptically filled as liquids for parenteral administration to patients. While a variety of dosage forms are available that accommodate aseptic liquid fill, vials and pre-filled syringes are used most frequently. These two dosage forms represent 70% of the total fill-line capacity for biopharmaceuticals.

Vials (53%) are the most versatile and easy to use dosage form. Prefilled syringes (17%) are becoming more widespread with the advantage of reduced loss from drug product overfill and improved patient safety (Figure 1). Both of these dosage forms have the additional benefit that drug product can be lyophilized in situ after filling. Other dosage forms are chosen to a lesser extent, but may be developed and validated later in the drug product life cycle to improve safety and convenience for both patients and healthcare workers.

As a whole, the CMO industry capacity utilization rate is 65%, which is expected to increase slightly in the coming years as biopharmaceuticals move through the pipeline. Most CMOs report their fill capacity utilization rates between 71% and 80%; however, capacity utilization rates vary widely. CMOs with lower capacity utilization are typically new entrants that have only been in the fill-and-finish business a few years, while European CMOs show high capacity utilization regardless of the number of years they have been offering fill-and-finish services for parenteral products.

Figure 1. Percent of fill lines available among contractor respondents for various dosage forms

Opportunities

Biopharmaceuticals are large, complex, fragile molecules requiring specialized handling during fill-and-finish. In addition to needing an aseptic environment, biologics are sticky and pressure sensitive. To accommodate these special needs, CMOs routinely use coated or nonreactive components and gentle pumps to preserve the biological activity of the final drug product. Increasingly, new products in the pipeline require further special handling.

For example, antibodies conjugated to cytotoxic small molecules need sophisticated containment to protect personnel or live bacterial vaccines that must be kept alive and prevented from escaping. These new products provide an opportunity for CMOs to develop different specialized expertise rather than increasing capacity for biologics with routine manufacturing needs.

Biotechnology companies also use CMOs for innovative stabilization formulation. Lyophilization is the most frequently used stabilization technology, but it is a finicky procedure and challenging to scale up. Many biotechnology companies can accommodate their liquid-fill drug products with internal resources but will outsource any lyophilized products. Biotechnology companies are seeking formulation processes other than lyophilization in order to reduce the cost and problems associated with lyophilization. In addition, certain biopharmaceuticals are not stabilized by lyophilization; therefore, they need a different stabilization method.

An example of a CMO investing to meet these needs is Boehringer Ingelheim Pharma. According to Friedrich Haefele, head of fill-and-finish biopharma, “We offer the whole range from drug product development to final packaging. We have expertise in pre-formulation/formulation, packaging and process development as well as clinical supply capabilities for Phases I–III and we are very flexible regarding packaging formats and a wide range of batch sizes.”

Haefele also notes that Boehringer Ingelheim has addressed these specialized needs by “implementing innovative drug delivery technologies according to the trends on the current global market for vials (liquid and freeze-dried) in isolator technology and pre-filled syringes in a restricted access barrier system. We are currently constructing a new line in isolator technology for liquid and double chamber cartridges. We expect installation at the end of 2011, and operation in 2013. We have high flexibility to manufacture a wide range of batch sizes and primary packaging formats.”

Business Trends

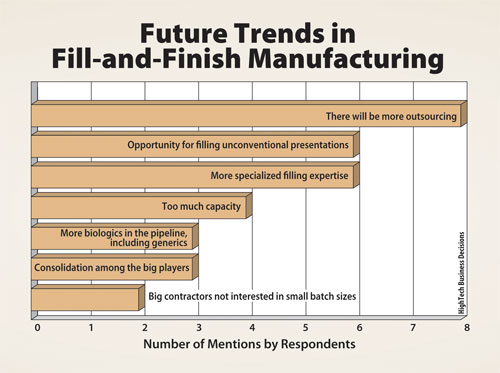

In our research, the biomanufacturing directors discussed the business trends they see in the biopharmaceutical fill-and-finish contract manufacturing industry. Generally, there is a trend toward more outsourcing of fill-and-finish production by both large and small biopharmaceutical companies. The biotechnology companies see outsourcing as a way to reduce their capital expenditure requirements, reduce risk, and gain access to specialized capability.

Some of the biomanufacturing directors see excess CMO capacity primarily for routine fill-and-finish requirements; however as more biologics come into the pipeline, including generics and biosimilars, this can change quickly. It is expected that the excess contract capacity will lead to further industry consolidation.

Biomanufacturing directors interviewed for the report also see opportunities for CMOs that have niche expertise focusing on smaller and specialized batches. A summary of future business trends is shown in Figure 2.

Figure 2. Future trends in fill-and-finish manufacturing

Conclusion

Contract fill-and-finish manufacturing companies provide an important service to biopharmaceutical companies. Few companies are large enough or have enough fill-and-finish needs to justify building, validating, and maintaining internal fill-and-finish capacity. While there is capacity available for routine drug product manufacturing, more unusual drug products requiring special handling are moving through the pipeline. CMOs are investing in new capacities and capabilities to meet these needs.

Jennifer Hartigan, Ph.D., is senior scientific director, and William Downey ([email protected]) is president at HighTech Business Decisions.