July 1, 2011 (Vol. 31, No. 13)

Industry Demands Better Technologies as Logjams Weigh Down Manufacturing Operations

Over two-thirds of biopharmaceutical manufacturers now report that their facility is experiencing capacity bottlenecks due to downstream processing. A number of factors continue to converge to create these constraints. As shown in our 8th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, industry concerns over downstream processing, particularly purification, are not improving.

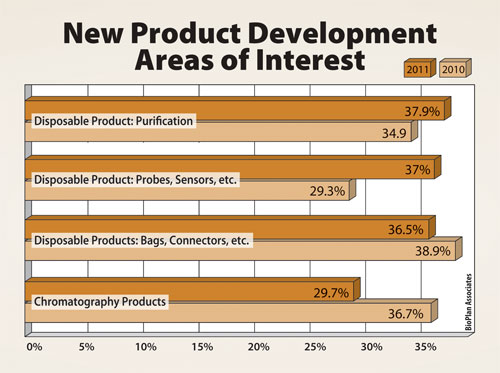

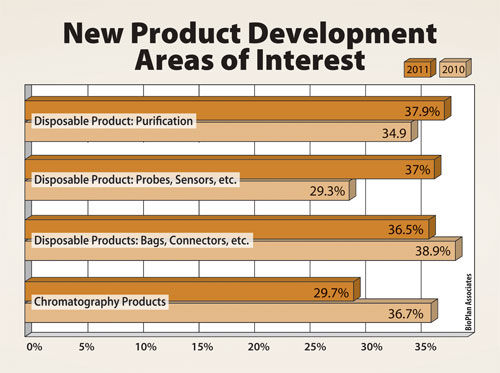

As a result, the industry is looking to vendors for solutions (Figure). In the study, we asked the 352 global respondents this year to consider the new products and services their suppliers are developing for the industry, and asked, “What are the top areas you want your suppliers to focus their development efforts on?”

This year, of the dozens of new product innovations, the largest portion of respondents cited “disposable product: purification” (37.9%), which was up significantly since 2010. This suggests that respondents’ requirements are not being satisfied with current technology. In fact, common chromatography products lost ground this year in terms of demand for new technologies. The need for improvements was clear in a number of areas covered by the study.

Dramatic technological improvements in upstream bioprocessing have resulted in downstream problems. Upstream bioprocessing performance comes from improved expression systems, better cell lines, optimized culture media and media supplements, and more efficient bioreactors. Modern upstream systems are providing higher yields, often at concentrations that many purification process technologies and equipment were not designed to handle efficiently.

Downstream processing has proven resistant to implementation of single-use/disposable equipment. While smaller-scale upstream biomanufacturing, such as for R&D and clinical supplies, is now well-acquainted with single-use/disposable bioreactors and other equipment, the options for single-use equipment for downstream processing remain limited.

Today, downstream operations typically involve expensive chromatography media, filters, and other supplies. For example, the study shows that the great majority of mAb manufacturers would like to eliminate the high cost of protein A affinity resins, but alternatives are limited.

Respondents in the BioPlan survey were asked to describe the impact their downstream purification processes were having on their overall manufacturing capacity, i.e., to characterize the magnitude of bottlenecks created by downstream processes. A total of 68.5% noted that their facility was experiencing at least some degree of capacity bottleneck as a result of downstream processes. This included 48% indicating their facility experienced “some” or “serious” production problems.

Reports of serious problems in downstream processing have been steadily increasing in recent years, with 11.8% of respondents reporting that their facility is currently experiencing a “serious bottleneck,” compared to 4.6%, 8.1%, and 9.0% in 2008, 2009, and 2010, respectively. With capacity bottlenecks more likely affecting larger-scale manufacturing, the nearly 12% reporting serious problems likely represent a higher percentage of late-stage and commercialized biopharmaceutical products.

Western European respondents reported experiencing a much higher level of “serious” problems, 18.9%, than those in the U.S. (9.3%). However, reports of “some” bottleneck problems continue to be much higher in the U.S., 45.3%, versus 21.6% for Europe. Apparently, U.S. companies experience more problems overall, but not as acute and serious as in Europe.

When biopharmaceutical manufacturers were asked to list the top areas on which they want suppliers to focus their development efforts, disposable bags and connectors were at the top of the list.

Necessary Improvements

Biomanufacturers’ budget trends are a direct indicator of their need for improvements. This year the trend for increased budgets in downstream areas continues. In fact, of the 12 budget areas we measured, downstream areas showed the highest budget growth. Respondents noted that their downstream budgets increased an average of 2.5% in 2009, 4.2% in 2010, and 6.4% for 2011.

With the downstream processing equipment market estimated to be on the order of $5 billion/year, and with so much unmet demand for improvements, many companies are working on solutions that involve either modified or novel downstream processes and/or equipment to enable greater throughput in downstream operations. However, the survey clearly shows that new technologies and solutions have not yet resolved the issue. This is because newer technologies are largely still in development or not yet ready for commercialization.

Another direct indicator of need for improvements is in avoidance of capacity constraints. When asked about where improvements could reduce capacity bottlenecks, the majority (51.4%) noted, “Develop better downstream purification technologies.” In addition, 37.6% cited “Optimize systems to improve downstream purification performance.” When considered together, the development of improved purification technologies was clearly the area of bioprocessing where improvements are most desired. In contrast, concerns with upstream processing problems have been steadily decreasing. This shows the relatively recent and rapid resolution of capacity constraints associated with upstream bioprocessing.

Downstream Areas for New Solutions

We evaluated new downstream technologies that respondents are considering currently, and compared this to last year’s responses. Of the 21 technologies identified, we found a strong and steadily growing interest in high-capacity resins and in-line buffer dilution systems. In addition, single-use filters are growing rapidly, as are disposable UF systems. The most rapid year-on-year growth has been in single-use prepacked columns.

In terms of actually testing and implementing new downstream technologies, over half of the respondents reported having used or evaluated membrane-based technologies, and just under half have “developed processes with fewer steps”, but relatively few have switched to alternatives to protein A or have worked with continuous, e.g., simulated moving bed, chromatography.

Desire for more and improved single-use/disposable equipment was a recurring theme in the study, with single-use equipment now widely recognized as providing cost savings, flexibility, and other benefits compared to fixed, usually stainless steel, equipment.

In addition to increased demand for single-use/disposable equipment, there are a number of platform-level technological improvements that many companies are exploring to improve downstream processing, particularly purification. This includes:

- simulated moving bed chromatography;

- chromatography resins that are cheaper, faster-flowing, more selective, and have higher binding capacities;

- novel separation methods, such as chromatography monoliths, involving casting media as needed as solid columns;

- alternatives to protein A;

- adoption of disposable protein A columns for antibody purification;

- new and improved depth, ultrafiltration and membrane filters, including those capable of replacing more chromatography columns;

- increased use of product-customized affinity purification media; and

- improved modeling of separations at the molecular and process levels to enable better process predictability and optimization.

The pendulum continues to swing toward resolving downstream bottlenecks, and the industry continues to invest in ways to improve its technologies. Some solutions may reside in improved upstream process development that shifts from improvements in cell culture and fermentation toward more purified targets in the supernatant. Others may present entirely novel alternatives to current technologies. At some point in the future, major issues in downstream bottlenecks will be resolved, and the pendulum will return to upstream and other areas of process improvement.

Biopharmaceutical manufacturers have serious concerns about inefficiencies in downstream processing and are looking to vendors to provide much-needed solutions. Sartorius Stedim Biotech is one of the companies introducing new products to reduce or eliminate the bottleneck that is hampering efficient bioprocessing.

Eric S. Langer ([email protected]) is president and managing partner at BioPlan Associates.