Five years after Johnson & Johnson’s Janssen Biotech subsidiary ended an earlier collaboration, Capricor Therapeutics has found a new partner for its lead pipeline candidate CAP-1002. The company is gearing up to study the cell therapy in a pivotal Phase III trial in Duchenne muscular dystrophy (DMD).

Nippon Shinyaku, which does business in the U.S. through subsidiary NS Pharma, has inked an up-to-$735 million exclusive U.S. commercialization and distribution agreement for CAP-1002 in DMD.

Capricor President and CEO Linda Marbán, PhD, told GEN Edge her company first met with representatives of NS Pharma two years ago at the J.P. Morgan 38th Healthcare Conference—the last JPM conference to be held in person in San Francisco.

“Once we connected with their team and saw their energy for CAP-1002, coupled with their presence in the DMD space in the U.S. and the fact that they had an approved drug for DMD, as well as their efforts in trying to build out their U.S. operations, Capricor decided they would be the ideal partner for us to commercialize CAP-1002,” Marbán said.

Investors have appeared to agree with Marbán, sending the share price of Capricor’s low-cap stock soaring more than 20% on the day the deal was announced (January 25), to $3.44 from $2.83 the previous day. Since then, the share price has climbed to $3.57 at the close of trading Monday, the same day Joseph Pantginis, PhD, Director of Research and a Managing Director at H.C. Wainwright & Co., raised the firm’s price target for Capricor from $14–$18 a share.

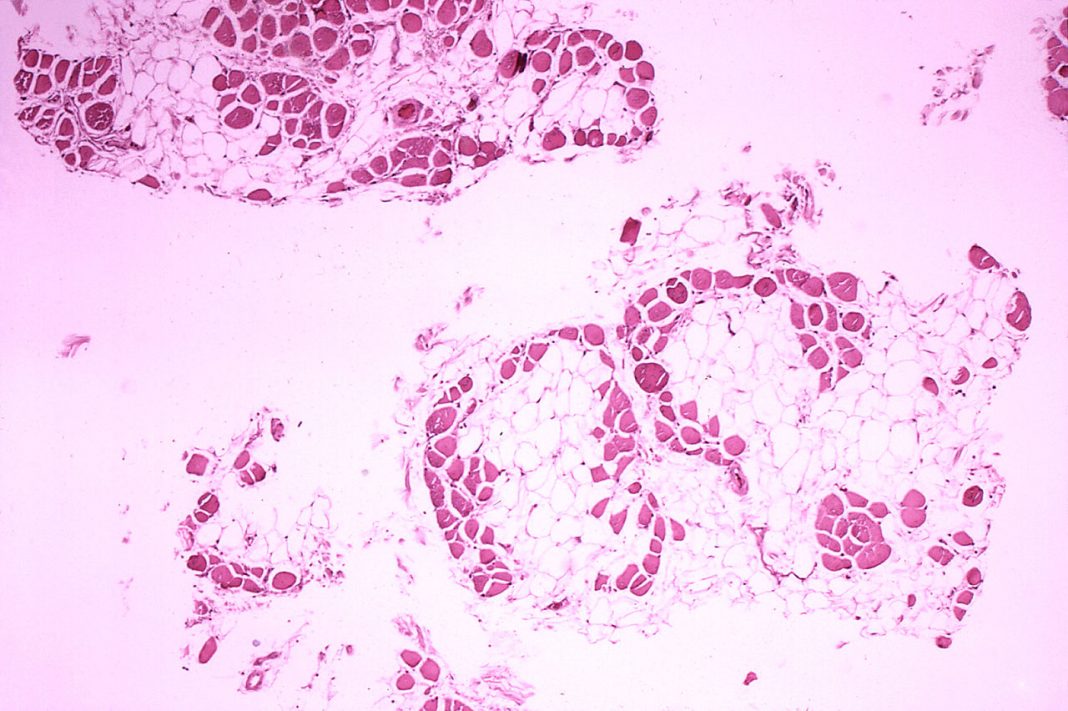

CAP-1002 consists of human allogeneic “off the shelf” cardiosphere-derived cells or CDCs, a type of cardiac cell therapy first identified in the lab of Capricor’s scientific founder Eduardo Marbán, MD, PhD, while he was professor of cardiology, physiology and biomedical engineering at The Johns Hopkins University. Marbán, who is Linda Marbán’s husband, is now Executive Director of the Smidt Heart Institute at Cedars-Sinai in Los Angeles.

NS Pharma’s U.S. presence in DMD is anchored by a marketed drug, Viltepso® (viltolarsen), which the company co-designed with Japan’s National Center of Neurology and Psychiatry. Viltepso is a morpholino antisense oligonucleotide indicated for DMD in patients amenable to exon 53 skipping.

Viltepso won FDA accelerated approval in 2020 after a clinical study showed an increase in dystrophin in patients dosed with the drug. In that study, dystrophin levels increased, on average, from 0.6% of normal at baseline to 5.9% of normal at week 25. Under its accelerated approval, NS Pharma was required to confirm Viltepso’s clinical benefit through a Phase III trial (NCT04060199) that is now recruiting patients, and whose primary completion date is estimated at November 2024.

Phase III trial planned

The NS Pharma-Capricor partnership will support the planned Phase III HOPE-3 trial (NCT05126758), which Capricor will oversee. Just two weeks before announcing the NS Pharma collaboration, Marbán said the trial would not begin without a partner.

Capricor says it plans shortly to launch HOPE-3, which pending FDA approval is expected to be the pivotal trial of CAP-1002 in DMD. “We anticipate that we will roll out really quickly, and then, once the last patients are in, the clock starts ticking for a year. It’s a two- to three-year endeavor,” Marbán said. “We’re anticipating enrolling the trials as a seven-nation, randomized trial in a highly needy patient population.”

Capricor will also oversee manufacturing of CAP-1002 and sell commercial product to Nippon Shinyaku, which will oversee distribution in the U.S. Nippon Shinyaku agreed to pay Capricor $30 million upfront, up to $705 million tied to achieving development and sales-based milestones, plus a “meaningful” double-digit share of product revenue.

HOPE-3 is estimated to enroll 68 patients, according to the trial’s ClinicalTrials.gov page.

“They [many DMD patients] really are not able to sustain a gene therapy,” Marbán added—an assertion she said was borne out in part by the recent death of a young male participant in a Phase Ib open-label study (NCT03362502) assessing Pfizer’s mini-dystrophin gene therapy candidate PF-06939926 in DMD. Marbán also cited some data disclosed by Solid Biosciences for its SGT-001, an adeno-associated viral (AAV) vector-mediated gene transfer therapy designed to address DMD’s underlying genetic cause.

In March 2021, Solid released data showing lesser response in three patients receiving a high dose of SGT-001 (2E14 vg/kg) compared with three patents receiving the low dose (5E13 vg/kg) as measured by the North Star Ambulatory Assessment (NSAA). High-dose patients showed a mean improvement in NSAA scores at one year of 0.3 points vs. baseline, compared with 1.0 point vs. baseline for the low-dose patients.

Solid noted that both results compared favorably to the mean decline of 4.0 points from baseline to one year shown by patients in a delayed treatment cohort, and that evidence of potential treatment benefit was also shown by results from a six-minute walk test (6MWT), pulmonary function tests (PFTs), and clinically validated patient reported outcome measures (PROMs). In September, Solid also reported positive 1.5-year data from IGNITE DMD in September at the World Muscle Society 2021 Virtual Congress and additional pulmonary function results from IGNITE DMD at the Child Neurology Society 50th Annual Meeting.

Marbán said Capricor carries out an allergy prevention regimen prior to infusion with CAP-1002: “The children get some antihistamines and a little bit of steroids, just to make sure that they don’t mount an immune response or have an allergy event. It’s very safe.”

Market challenge

While its CDC cell therapy differs from the gene therapy approaches of Solid and Pfizer, all three companies aim to bring treatments to market against DMD, which along with Becker muscular dystrophy affect one in 3,500 to 5,000 newborn males worldwide, according to the NIH. (Becker is a milder form of muscular dystrophy than DMD, caused by different mutations in the dystrophin gene).

Sarepta Therapeutics has come to lead the category of marketed DMD drugs by winning FDA approval for three antisense oligonucleotides for patients amenable to skipping specific exons. Sarepta is also developing two other DMD candidates: RP-5051, a next-generation peptide-conjugated phosphorodiamidate morpholino oligomer (PPMO) for exon 51 skip-amenable Duchenne patients; and SRP-9001, a micro-dystrophin gene therapy being co-developed with Roche through an up-to-$2.85 billion collaboration.

Sarepta’s three approved DMD therapies—EXONDYS 51 (eteplirsen), VYONDYS 53 (golodirsen), and AMONDYS 45 (Casimersen)—generated $612 million in 2021 revenue last year, Sarepta disclosed at this year’s virtual J.P. Morgan conference, including $178.7 million in fourth-quarter revenue; both figures are unaudited, Sarepta cautioned.

Sarepta has guided investors to projecting its three marketed DMD drugs will generate a combined more than $800 million in revenue this year—a more than 30% one-year revenue jump, following a revenue compound annual growth rate (CAGR) of 40% between 2017 and 2021.

“The FY2022 sales guidance for Exondys, Vyondys and Amondys, of $800M+, would be a significant continuation of growth for the franchise, and is a bit ahead of our previously modeled FY2022 guidance of $775M,” Baird’s Brian Skorney, CFA, Senior Research Analyst, and Luke P. Herrmann, Research Analyst wrote in a January 10 research note. “We are encouraged by this growth and believe the PMO [phosphorodiamidate morpholino oligomer] franchise will continue to provide helpful liquidity as SRP-9001 and SRP-5051 approach potential approvals and progress in the other indications continues.

Also earlier this month, Sarepta released topline data from Part 2 of its Phase II SRP-9001-102 trial (“Study 102”, NCT03769116) showing 20 SRP-9001-treated participants ages 5-8 from the placebo crossover group scored statistically significant NSAA improvement of 2.0 points from baseline at 48 weeks following treatment. However, the improvement was only 1.3 points for the SRP-9001 treated group and-0.7 for 103 participants in the external control group.

While Skorney and Herrmann said investors expected 2-point improvement in the treated group, Joseph P. Schwartz, Managing Director, Rare Diseases and a senior research analyst with SVB Leerink, called the 48-week NSAA benefit “compelling in the context of DMD natural history.”

Capricor says CAP-1002 is not envisioned as a direct competitor with the Sarepta, Solid, and Pfizer therapies.

Good in the sandbox

“All those other products are looking for dystrophin replacement and have a variety of degrees of success in terms of doing that. Our product is, I like to say, the colloquial good player in the sandbox,” Marbán said.

“It’s an immune modulator and then it draws endogenous muscle cells back into the cell cycle. Even if the children are getting gene therapies, they would want CAP-1002 because it allows better muscle repair, and better integration of gene therapies into the treatment paradigm because of its immunomodulatory component.”

As a result, Marbán envisions physicians adding CAP-1002 to any treatment regimen in DMD, rather than Capricor partnering with any of the gene therapy developers on a combination therapy.

CAP-1002 has the FDA’s Orphan Drug and Regenerative Medicine Advanced Therapy (RMAT) designations. Because DMD is a rare pediatric disease, CAP-1002 would be eligible for a Priority Review Voucher If Capricor receives market approval.

Commercializing CAP-1002 and technologies developed by Eduardo Marbán and collaborators were among the original priorities when Capricor was founded in 2006, adjacent to Johns Hopkins and his lab. The company went public in 2013.

“We thought we had discovered a stem cell that was going to treat heart disease,” Linda Marbán recalled. “In the fast forwarding of a decade and a half since that time, we have learned that the cells that we had were not stem cells. They were actually a stromal cell population that carries inside of them exosomes that mediate muscle repair, as well as profound immunomodulatory activities.”

When Eduardo Marbán moved his lab to Cedars-Sinai two years later, Capricor moved west to Los Angeles. Linda Marbán, a co-founder of Capricor, became CEO in 2010. Three years later, the company moved its headquarters to Beverly Hills, CA.

Also in 2013, Capricor found in Janssen a partner for developing CAP-1002 and other cell therapies for cardiovascular applications. The companies inked a collaboration with Capricor that was envisioned as generating up to $337.5 million plus royalties for Capricor—including the $12.5 million that Janssen paid upfront, and the up-to-$325 million Capricor would have received had Janssen exercised option rights to CAP-1002.

But in May 2017, Capricor acknowledged that an analysis of results from the Phase II ALLSTAR trial (NCT01458405), which assessed CAP-1002 in myocardial infarction, “showed a low probability that CAP-1002 would achieve the primary endpoint of scar size reduction.” Two months later in July 2017, Janssen opted not to license CAP-1002 and handed back to Capricor rights to the cell therapy, ending a three-and-a-half-year collaboration between the companies.

Challenging years

Janssen’s termination touched off a challenging couple of years for Capricor, during which the company explored strategic alternatives for one or more of its products. In March 2019, Capricor eliminated about just over half its workforce, 21 full-time positions, leaving the company with 18 full-time employees and four part-time employees according to the Form 10-K Annual Report it filed later that month.

Capricor also repositioned CAP-1002—whose original indications included treatment of heart disease associated with DMD—into a Duchenne treatment, after seeing in preclinical models the cell therapy’s mechanism of action, which showed potential to decrease inflammation and slow muscle degeneration while exerting positive effects on muscle regeneration. These outcomes, Capricor reasoned, may translate into patients retaining muscle function for a longer period of time.

Capricor generated positive data in the Phase I/II HOPE-Duchenne trial (NCT02485938) in 2017. Last September, the company reported positive data from its Phase II HOPE-2 trial (NCT03406780) showing that CAP-1002 met the study’s primary efficacy endpoint of mid-level Performance of Upper Limb (PUL) version 1.2. CAP-1002 generated scores that on average were 2.6 points higher in the eight non-ambulatory DMD patients dosed with the cell therapy (150 million cells per infusion) compared with 12 placebo patients. CAP-1002 also met various skeletal and cardiac endpoints suggesting clinically relevant slowing of disease progression.

CAP-1002 is also in development as a COVID-19 therapy, for which it is under study in the Phase II INSPIRE trial (NCT04623671), which completed enrollment at 63 patients in November. Capricor plans to release topline data from INSPIRE during the first quarter. Should that data prove positive, Marbán said, “we’ll take it to the FDA, and strategize with them the best path forward.”

In addition to CAP-1002, Capricor is developing an exosomes program that includes a multivalent exosome-based messenger RNA (mRNA) vaccine for preventing COVID-19, as well as engineered exosomes loaded with mRNA and other nucleic acids for use in drugs and vaccines. In November, researchers from Capricor and Johns Hopkins published promising preclinical data in Journal of Biological Chemistry for the COVID-19 vaccine showing exosomes could deliver functional mRNA to and into cells in vivo.

In its quarterly regulatory filing for Q3 2021, Capricor said it was developing therapeutics and vaccines for infectious diseases, monogenic diseases and other indications. Capricor is also completing non-clinical studies for submission with future Investigational New Drug (IND) applications.

Platform development strategies

“We are very close now with the preclinical work, and we are going to be coming forth with some of our platform development strategies over the course of 2022,” Marbán said.

Last year, Capricor named Kristi Elliott, PhD, as vice president of R&D to oversee exosome platform and pipeline development.

The exosome program also includes CDC-derived exosomes starting with CAP-2003. In August 2021, researchers from Capricor and the U.S. Army Institute of Surgical Research (“USAISR) published a preclinical study in The Journal of Trauma and Acute Care Surgery showing the potential of CAP-2003 as an antishock treatment, especially if given early

The company filed an IND application with the FDA in 2020 to study CAP-2003 in patients with DMD. The FDA has requested additional information from Capricor related to manufacturing.

“When we figured out the [CDC] cells weren’t stem cells, but they were mediating a long term biologic response, changing how muscles function, reducing the size of heart attacks, showing profound immunological activity, we went on a journey to discover the mechanism of action in the cells: How is this happening?” Marbán recalled.

Capricor learned that exosomes isolated from the CDC cells acted as messengers to regulate the functions of neighboring cells. The company’s preclinical research showed that exogenously-administered exosomes can direct or sometimes re-direct cellular activity, thereby supporting their therapeutic potential.

“We discovered that the exosomes were actually the words of cells or how cells communicated information to each other, and also gave themselves tools to deal with the stresses and strains of life,” Marbán said. “We were able to figure out that the exosomes isolated from our cells contained certain microRNAs and other non-coding RNAs that seem to correlate and mediate the mechanism of action of the cells.”

Since 2019, Capricor’s staff has rebounded to 42 people, with plans to expand its headcount this year: “We expect to grow somewhere around 10 people,” Marbán said. “We’re still hiring to allow for the development of this engineered exosome platform.”

More than 20 Capricor staffers are based at its new San Diego R&D headquarters, an approximately 10,000-square-foot facility that more than tripled the company’s available lab space. The facility focuses on both Capricor’s cell and exosome-based platform expansion in multiple disease areas.

Longer-term, does Capricor see itself as a buyer, or a takeover target? The company isn’t hinting either way.

“We have two goals: We want to forward our products as quickly and as efficaciously as possible. And we obviously want to fulfill our fiduciary responsibilities to our shareholders, by managing the company appropriately,” Marbán said. “So, we’ll take advantage of the opportunities that come our way.”