Marcia Kean

Tracy Webb, Ph.D.

How we resolve current issues with genetic testing will shape consumer genomics.

From nanopores to nanoballs, DNA sequencing technologies have come a long way in speed and cost since the Sanger, or dideoxy chain termination method, used for the Human Genome Project. Such rapid innovation has driven companies to compete in a highly visible race to sequence an entire human genome for $1,000 vs. the $3 billion cost of the first human genome.

The technology underpinning the $1,000 genome is merely a catalyst of the current drama surrounding this field. What’s the true value of a $1,000 genome? For researchers it will enable ambitious genomic research projects to understand the relationship between genes and disease. For consumers it will put within tantalizing reach of the average person a level of self-knowledge that has been sought after since time immemorial. For patients and healthcare providers it may offer the keys to a Pandora’s box of knowledge about predisposition, prognosis, and potential response to treatment.

Indeed, we are witnessing high-profile controversies surrounding direct-to-consumer (DTC) genetic testing, like their perceived value, the role of FDA regulation to protect the consumer, patient privacy, etc. These are symptoms of tectonic shifts in the relationships between prevention and treatment, between patient and physician, as well as between individuals and their past, present, and future families. In other words, the $1,000 genome is code for a revolution that goes far beyond mere biological understanding.

The Automobile and the Genome

A key aspect of personalized health is the adoption of consumer genomics. By understanding an individual’s disease predisposition, genetic information may prove to be extremely effective in reducing healthcare costs—and saving lives—through prevention programs.

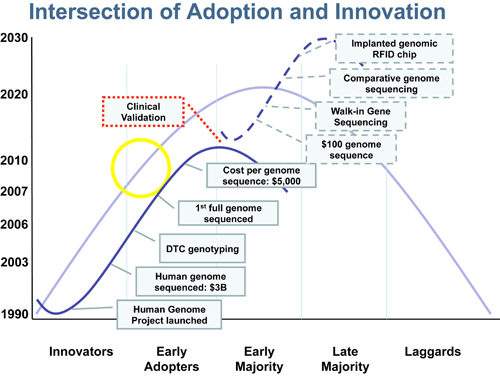

Traditionally, market adoption of technology occurs on a bell-shaped curve. We expect the same will hold true for consumer genomics. Innovation, on the other hand, is represented by an S-shaped curve. The first consumer genomics innovation curve began with the Human Genome Project. As the genome was sequenced and the ability to perform genotyping progressed, the introduction of DTC genetic testing companies and a rapid decrease in the price of full-genome sequencing soon followed (Figure). But as this first innovation curve tapers off and before we begin the second wave, we have to fill a gap between the “early adopters” (i.e., influential technology enthusiasts who are keen to have new technologies before they are fully developed) and the “early majority” (i.e., individuals driven by a sense of practicality who adopt technology only once it has an established record of success). It is important to note that this is the point where new technology-based products are most likely to fail. To bridge this critical gap consumer genomics needs to be clinically validated to demonstrate a genuine benefit to health.

Consider one innovative technology example: the automobile. At first the automobile offered speed but was notoriously unreliable. Over multiple decades, not only did this innovative technology develop further and further to almost unfailing reliability, convenience, and cost-effectiveness, but it also resulted in the birth and development of an entirely new service industry. A supporting infrastructure was built, including roads, highways, gas stations, and car mechanic and maintenance shops. In short, the automobile not only changed travel, it spawned new sectors of the economy and shifted the relationships between individuals and society.

Similarly, following clinical validation of consumer genomics products over time, a second innovation curve will begin that we can barely imagine today. This next wave is likely to include $100-or-less genome sequencing (i.e., affordable by just about everyone), walk-in genome sequencing centers for immediate answers, products that compute in real-time the value of certain diets tracked against one’s genomic predispositions, and countless customized services to maximize health and longevity. The possibilities are endless. Most importantly, clinical validation of consumer genomics will pave the way for further product innovation in disciplines complementary to genomics. For example, epigenomics will help us better understand the influence of our environment on phenotype, and proteomics will be able to tell us what is happening in patients in real time.

Beyond the Immediate Benefits

As we pen this article, a Congressional investigation is under way that has drawn the media to describe consumer genomics as “snake oil.” It is not, in our opinion. Rather, consumer genomics is the Model T of our age—innovative but unreliable, wondrous but not yet fully developed.

What can aid the success of consumer genomics is an understanding and open-mindedness about the vast potential that the technology affords, bounded by appropriate regulatory and privacy constraints. The immaturity of the consumer genomics market means that there are many uncontested market spaces that are waiting to be claimed. Finding and capitalizing on these unexplored arenas will be the next stage of the innovation curve, resulting in consumer products that will drive the acceptance and adoption of this technology into conventional medicine.

Infrastructure: The core infrastructure for consumer genomics will likely include, at a minimum, a few key elements. First, we need to determine how to handle the massive amounts of raw data that large-scale genome sequencing will produce. Where do we put all that data? Who will own it? How will it be analyzed and harnessed?

Second, analytics and clinical decision-making tools must be developed to understand what the data, or the genomic sequence, actually means for the patient and how the physician should use the knowledge to the best advantage in a clinical setting. Third, new data privacy approaches will be needed to overcome the main hurdle to widespread consumer adoption. Finally, provider reimbursement must be defined for preventive approaches. Preventive medicine has historically been very difficult to accomplish and genetic information may be the lynchpin needed to get both consumers and providers to preempt potentially dangerous and costly medical procedures downstream.

Product and Service Innovation: When the $1,000 genome becomes reality and the core infrastructure is in place, DTC genetic testing companies will likely move away from genotyping and toward full-genome sequencing. Further product innovation will result as each company attempts to differentiate itself. Medical software will require much more sophisticated data-analysis capabilities, and as the use of electronic health records grows, these will naturally have to be integrated with the data-analysis software to ensure accurate data reporting.

As part of the empowered patient movement, consumer devices will allow for the integration of genomic data and knowledge into consumer electronic devices. In other words, the iPad and iPhone will help us toward healthier choices, on-demand health services, and rapid interventions when health erodes. And the pharmaceutical industry, already exploring genomics-based approaches to product development, will use those on-demand tools to recruit for genetically defined clinical trials to cost-effectively develop products targeted to smaller and smaller subgroups of the population.

Conclusion

Genetic testing is already having an impact on the way patients are treated, especially in the field of oncology. We can surely anticipate acceleration and intensification of this trend as entire genomic sequencing and analysis becomes inexpensive and eventually commoditized. Market adoption of consumer genomics will help shift us toward personalized, preventive, and participatory medicine. But innovation on its own can only take us so far. The way we address the current regulatory, legal, and privacy issues surrounding genetic testing will have a profound effect on the speed at which consumer genomics develops and has an impact on health.

Marcia Kean, is CEO, and Tracy Webb, Ph.D., is vp, life sciences at Feinstein Kean Healthcare.