Abivax is ringing in the new year with a pivotal Phase III program underway for its lead candidate obefazimod in moderate to severe ulcerative colitis (UC), the first of three indications for which the Paris-based biopharma is developing the oral small molecule.

The global Phase III program aims to assess the safety and efficacy of two dosages of obefazimod, 25 mg and 50 mg, in both patients who have either failed advanced therapies (AT) or are AT-naïve. The program consists of two induction studies—ABTECT-1 (ABX464-105; NCT05507203) and ABTECT-2 (ABX464-106; NCT05507216), as well as a subsequent ABTECT maintenance trial (ABX464-107; NCT05535946). All three studies are randomized, double-blind, and placebo controlled, using independent, blinded review of videotaped endoscopies.

The program is expected to evaluate 1,200 UC patients ages 16 and over at 600 study sites in 36 countries, 600 patients per induction study. In both induction studies, patients will be treated for eight weeks in this program. The first patient in the United States was dosed with obefazimod in October.

“We are expecting to recruit roughly 25% of the overall study population, of the overall number of patients in the United States,” Hartmut J. Ehrlich, MD, Abivax’s CEO, told GEN Edge.

Patients from both induction studies who demonstrate a clinical response of at least a 30% improvement in symptoms will be enrolled in a single maintenance study. The program’s primary efficacy endpoint will be clinical remission according to the modified Mayo Score, as required by the FDA and as assessed at week 8 in the induction and at week 44 in the maintenance study.

Topline results are expected by the end of 2024 for the induction studies, and by the end of 2025 for the maintenance study. Should the studies yield positive results, Abivax plans to file for regulatory approvals early in 2026.

Also during 2023, Abivax is expected to begin developing obefazimod for inflammatory bowel disease (IBD) starting with UC in children ages 2–17, following FDA approval of a Pediatric Study Plan (iPSP) that the company announced on Tuesday.

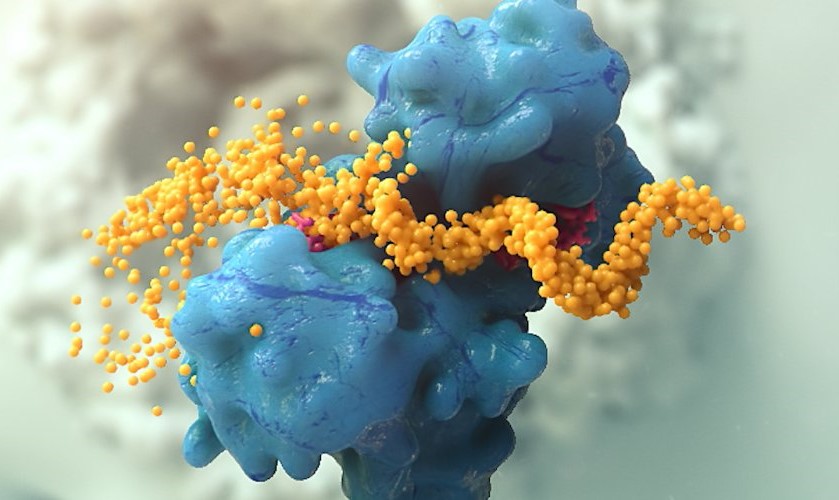

Obefazimod is designed to upregulate miR-124, an anti-inflammatory microRNA. Obefazimod enhances the selective splicing of a single long noncoding RNA to generate miR-124, which downregulates cytokines and chemokines shown to promote inflammation, including tumor necrosis factor (TNF) alpha, IL-6, monocyte chemoattractant protein-1 (MCP-1) and IL-17, as well as Th17+ cells. Under its former name ABX464, obefazimod was initially developed against HIV but was repurposed to fight inflammatory conditions based on its anti-inflammatory effect.

Obefazimod’s anti-inflammatory effect is believed to be triggered when the molecule binds to its target, the cap binding complex located on the 5′ end of every cellular noncoding RNA molecule. The binding results in the splicing of a long, noncoding RNA that induces the overexpression of miR-124, which launches a cascade that is believed to propagate the drug’s anti-inflammatory effect.

“If they’re binding to their target genes, they actually block the translation of target genes. Some of these target genes that we are talking about here are IL-17, interleukin-17 and interleukin-23, also TNF alpha and IL-6,” Ehrlich said. “By binding, the expression of these cytokines is essentially reduced.

“It’s typically in contrast to the way monoclonal antibodies work. They can block 100% of the activity of a certain cytokine. Here, we are having a broader approach,” Ehrlich added.

Sweet spot

Abivax envisions obefazimod as a first-line treatment for UC and Crohn’s after failure of conventional treatments—a sweet spot now occupied by several tumor necrosis factor alpha (TNF-α) inhibitors, of which the best-selling drug is AbbVie’s multi-indication blockbuster Humira® (adalimumab), which generated $15.658 billion in Q1–Q3 2022, up nearly 2% from $15.36 billion a year ago. Being a biologic, Humira will start to see competition from lower cost biosimilars starting in 2023, though its patent protection doesn’t end until 2034.

Additional biologics with UC indications include another TNF inhibitor, Remicade® (infliximab), marketed by Johnson & Johnson’s Janssen Biotech; another J&J (Janssen Immunology) drug, the human interleukin-12 and -23 antagonist Stelara® (ustekinumab); and Entyvio® (vedolizumab), an integrin receptor antagonist marketed by Millennium: The Takeda Oncology Company.

Stelara racked up $7.336 billion in Q1–Q3 2022, up 7.9% from $6.8 billion a year ago; and Remicade, $1.868 billion, down 23% from $2.426 billion. Entyvio—Takeda’s biggest-selling product—generated ¥521.8 billion ($3.848 billion) in sales in Takeda’s last full fiscal year, which ended March 31, 2022, up 21.5% from ¥429.3 billion ($3.166 billion) a year earlier. Since then, Entyvio has racked up ¥646.6 billion ($4.768 billion) in the first half of the company’s current fiscal year, up 35% from ¥255.9 billion ($1.887 million) in April–September 2021.

Obefazimod would also compete with other oral small molecule drugs, including Bristol Myers Squibb (BMS)’s sphingosine 1-phosphate receptor modulator Zeposia® (ozanimod), AbbVie’s Janus kinase (JAK) inhibitor Rinvoq® (upadacitinib), and another JAK inhibtor, Pfizer’s Xeljanz® and extended-release version Xeljanz® XR (tofacitinib).

During the first three quarters of 2022, Rinvoq generates $1.752 billion, up 38% from $1.134 billion in Q1-Q3 2021; Xenjanz, $1.304 billion, down 25% from $1.734 billion; and Zeposia, $171 million, nearly double from $99 million. Pfizer blamed the drop on lower prescription volumes since last year when the FDA began requiring the company to add a warning to its label about increased risk of serious heart-related events such as heart attack or stroke, cancer, blood clots, and death.

Other drugs indicated for UC or IBD include anti-inflammatory treatments such as 5-aminosalicylates and corticosteroids; immune system suppressants such as Azathioprine (Azasan, Imuran) and mercaptopurine (Purinethol, Purixan); and Cyclosporine (Gengraf, Neoral, Sandimmune).

Abivax discovered obefazimod after screening compounds from its library for the potential to modulate RNA biogenesis.

“For us, the Phase III is really important from the point of view of either confirming that the best induction results are being achieved with 50 mg, or that the 25 mg dose is as potent. We know [25 mg] was for the induction study, but we don’t know for the maintenance study, so that study will tell us at what dose we are intending to use the molecule for maintenance after licensure,” Ehrlich said. “This will either be 50 mg—provided that the dose, as it did in the past, is safe upon long-term treatment—or if the 25 is as good as the 50, especially for maintenance, then of course we would prefer moving forward with the 25 mg.”

Bruce Sands, MD, the Dr. Burrill B. Crohn professor of medicine at the Icahn School of Medicine at Mount Sinai and chief of the Henry D. Janowitz Division of Gastroenterology at Mount Sinai, serves as principal investigator of the studies in the United States.

Positive Phase IIb data

In September, Sands, Ehrlich, and 13 other researchers from Abivax and clinical partners published a study in the Lancet Gastroenteroology & Hepatology reporting positive data from a 254-patient Phase IIb induction and 48-week maintenance study (NCT04023396). The data showed all three doses of obefazimod (25 mg, 50 mg, and 100 mg) to have significantly improved moderate-to-severe active UC from baseline to week 8 compared with placebo, as measured by changes in modified Mayo Score (MMS).

At week 8, the least squares mean (LSM) change from baseline in MMS was –2·9 for patients dosed with 100 mg of obefazimod, –3·2 for the 50 mg group, –3·1 for the 25 mg group, and –1·9 for patients randomized to placebo. “This validates the safety and efficacy data generated with obefazimod in the initial phase IIa study in patients suffering from ulcerative colitis, including in a patient population refractory to biologics and/or JAK inhibitor treatments,” stated Séverine Vermeire, MD, PhD, head of the IBD Center at the University Hospitals Leuven, Belgium, and principal investigator of the Phase IIb study.

In April, Abivax reported positive data from the first 78 patients evaluated from its Phase IIb open-label maintenance study, showing clinical remission in 55.3% of 217 UC patients after 48 weeks of once-daily oral 50mg obefazimod. In the subgroup of 121 patients who had at least a clinical response after the 8-week Phase IIb induction study, 65.3% achieved clinical remission during the first year of maintenance treatment—compared with 66.7% in the company’s earlier Phase IIa study.

After UC, Abivax aims to develop obefazimod to treat Crohn’s disease and rheumatoid arthritis (RA). While the company has yet to conduct any clinical studies in Crohn’s, it is the first indication that Abivax is in process of financing since most UC treatments are also indicated for Crohn’s, and because its mechanisms of disease propagation are similar to those of UC, which like Crohn’s is a type of IBD.

Once that financing is available, Ehrlich said, Abivax will proceed with a Phase IIb study rather than spend time on a two-way proof of concept study, abiding by a recommendation of the company’s clinical trial steering committee, consisting of Sands, Vermeire, and William J. Sandborn, MD, of University of California, San Diego.

In RA, Abivax has completed a Phase IIa induction study (NCT03813199) in 60 patients with moderate to severe RA, for which it reported encouraging data in June 2021: The combination of once-daily 50 mg obefazimod and methotrexate met the study’s primary endpoint of safety and tolerability, during the 12-week induction phase.

Abivax acknowledged that the sample size was not powered to show efficacy—but added that patients dosed with 50 mg obefazimod showed statistically significant differences in the key secondary endpoint of 20% or greater improvement in disease activity as measured by American College of Rheumatology (ACR) criteria (ACR20) compared to placebo at week 12.

However, given limited cash, “clearly our focus at this point in time is to get the UC going, to work on funding and then get Crohn’s going, and hopefully after Crohn’s, rheumatoid arthritis.”

Raising Phase III capital

Abivax has estimated the cost of the Phase III obefazimod program in UC at €250 million ($265 million), consisting of €200 million through the release of maintenance study data, plus another €50 million to finish the program.

The company began raising that capital in September by completing an oversubscribed €49.2 million ($52.2 million) financing with a group of investors from the United States and Europe. TCGX led the financing, which included participation from Venrock Healthcare Capital Partners, Deep Track Capital, Sofinnova Partners, Invus, and Truffle Capital.

Abivax carried out the financing by raising approximately €46.2 million (about $49 million) through issuing 5.53 million new shares, representing 33% of its current share capital, at a subscription price of €8.36 ($8.87) per share—as well as by issuing €2.9 million (about $3.1 million) in royalty certificates.

The financing lengthened Abivax’s funding runway to the end of Q1 2023, based on the company prioritizing clinical development for obefazimod—with UC the top priority—and taking into account existing cash resources. The company finished the first half of 2022 with €26.57 million ($28.2 million) in cash and cash equivalents, down 56% from €60.701 million ($64.4 million) in H1 2021.

During January–June 2022, Abivax’s net loss more than doubled from a year earlier, to €29.553 million ($31.4 million) from €16.531 million (about $17.6 million). Revenue shriveled to €56,000 (about $59,500) from €9.64 million ($10.2 million), nearly all of that consisting of a one-off grant from France’s public investment bank Bpifrance toward a COVID-19 program for ABX464 that failed in 2021.

For the next 12 months following the September financing, Abivax has said, it will need approximately €100 million ($106 million)—the €46 million already raised, plus an additional €54 million ($57 million).

“What we are currently looking to fund in the short term is the money to get us to the induction readout, and here we are in the process of considering dilutive, as well as nondilutive options,” Ehrlich said. “We will report on them, of course, as quickly as these options turn into reality.”

In its Half-Year Financial Report 2022, released in September, Abivax stated that pursuing additional dilutive and non-dilutive financing “will enable it to meet its debt maturities until the third quarter of 2023.”

Avoiding cost-cutting

In announcing the September financing, Abivax warned that if it couldn’t raise the capital it needed for the Phase III program, it would “review cost-cutting measures which could entail postponing or suspending” some programs.

“The lion’s share of the expenses resting with our [clinical trial] partner IQVIA. So, this is not where we can and where we want to start cutting costs,” Ehrlich said. “We are looking into all options, but we are clearly confident that we will be able to raise the funding. And we don’t have to engage in major cost-cutting, because the crew at Abivax from the very beginning has been very small.”

Abivax employs about 70 people. Given the Phase III trial for obefazimod, Abivax expects to grow that workforce, Ehrlich said, though it has not specified how many positions it plans to add.

Obefazimod anchors a pipeline that includes a second clinical-phase candidate—ABX196, a synthetic synthetic glycolipid agonist of invariant natural killer T cells (iNKT) in a liposomal formulation administered intramuscularly. ABX196 is based on a proprietary platform technology designed to identify cells with immune enhancing potential in cancer models.

Ehrlich said Abivax is seeking a biopharma partner to advance ABX196 into Phase II and beyond, nearly a year after the company presented encouraging results in the dose escalation phase of a Phase I/II trial that it said supporting further development of the drug to treat hepatocellular cancer (HCC).

At the ASCO GI Cancers Symposium 2022, Abivax presented data from an open-label Phase I/II trial (NCT03897543) showing a clinical benefit in five of 10 patients treated with the combination of ABX196 and BMS’ cancer immunotherapy blockbuster Opvido® (nivolumab). One patient showed a partial response and the other four, stable disease. Median progression-free survival was 113.5 days (49-450 days) for all patients, and 276 days (172–450 days) among those showing a clinical benefit.

“Abivax is not an oncology company, and we really feel that in cancer indications, when you are developing state-of-the-art therapies, you need to have the experts with you,” Ehrlich said. “We really are looking into finding a partnership moving forward for this particular molecule, because our expertise is in inflammation, but not in oncology.”