Astellas Pharma has acquired Potenza Therapeutics for up to $404.7 million in a deal that bolsters the buyer’s cancer immunotherapy pipeline—more than three years after the companies launched an immuno-oncology collaboration that has produced two Phase I candidates and a third candidate bound for the clinic.

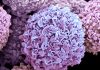

Headquartered in Cambridge, MA, Potenza is a four-year-old cancer immunotherapy developer whose treatments have sought to target immune stimulation, immune checkpoint inhibition, and regulatory T cell function.

The acquisition gives Astellas a portfolio of three novel INDs with the potential to treat various cancers that to date have proven unresponsive or resistant to current immuno-oncology therapies.

Included in the portfolio are two Phase I candidates. The lead program is ASP8374/PTZ-201, an anti-TIGIT antibody (immune checkpoint inhibitor) under study in a multiple-dose trial (NCT03260322) as both a monotherapy and in combination with Merck & Co.’s Keytruda® (pembrolizumab) in participants with locally advanced (unresectable) or metastatic solid tumor malignancies.

The other Phase I candidate is ASP1948/PTZ-329, an anti-NRP1 antibody (Treg function inhibitor) under study in a trial (NCT03565445) designed to assess the drug’s tolerability and safety profile in participants with locally advanced (unresectable) or metastatic solid tumors. The trial is also designed to evaluate the antitumor effect of ASP1948, characterize its pharmacokinetic profile, and determine a recommended Phase II dose of ASP1948.

Also in the portfolio is the Phase I-bound ASP1951/PTZ-522, a novel format Glucocorticoid-induced TNFR-related (GITR) agonistic antibody (T cell priming & costimulation) that according to Astellas recently won IND clearance from the FDA.

Last month at the 33rd Annual Meeting & Pre-Conference Programs of the Society for Immunotherapy of Cancer (SITC 2018), Potenza researchers reported that PTZ-522 “increases proliferation and inflammatory cytokine production by GITR expressing TILs [tumor-infiltrating lymphocytes]. Increased activity in the TIL assay is also observed with the combination of PTZ-522 with a PD-1 inhibitor.”

“These data support the continued development of PTZ-522 as a novel GITR agonist for the treatment of cancer,” the Potenza researchers concluded.

Potential for Combination Therapies

Therapies developed through the collaboration with Potenza, Astellas added, “may also provide a platform for IO [immuno-oncology] combinations with Astellas’ existing non-IO programs for lifecycle management and future novel IO combinations.”

Astellas paid $164.6 million cash upfront to acquire Potenza, with Potenza shareholders eligible for up to $240.1 million in additional payments tied to achieving clinical development milestones.

Potenza became a subsidiary of Astellas following the closing of the acquisition deal.

“We are extremely proud of what the experienced Potenza team has accomplished to discover and create innovative therapeutics for the treatment of cancers,” Dan J. Hicklin, Ph.D., Potenza’s president and CEO, said in a statement. “Over the past three and a half years, we have enjoyed a successful and productive partnership with Astellas. I am pleased that these therapies will now have access to the resources of a large international company, with world-class R&D and the strategic and financial backing to support the development of these innovative potential new medicines for cancer patients in need.”

Astellas and Potenza launched their cancer immunotherapy partnership in April 2015. At the time, the companies did not disclose the value of their collaboration but did say that Astellas acquired an option to acquire Potenza on pre-determined terms at the end of the collaboration period. Astellas also agreed to make an equity investment in Potenza and pay an option fee, research funding, and milestone payments.

Astellas became a major shareholder of Potenza after its VC arm, Astellas Venture Management, was among investors participating in the $38 million series A equity financing round closed by Potenza in December 2014. That financing was led by MPM Capital, with participation by InterWest Partners.

Astellas said it was reviewing the financial impact of the Potenza acquisition on results for its current fiscal year, which ends March 31, 2019.