Alex Philippidis Senior News Editor Genetic Engineering & Biotechnology News

Choosier companies, restless employees, overabundance of Ph.D.s lengthen time it takes to complete interviews.

Ryan Raver, Ph.D., still remembers entering a third round of interviews for a lab technician position back in 2007, when a prospective manager asked: Imagine you are a grape in a blender, with cherries and bananas and ice tossed on top of you. When someone pushes the “on” button and the blender starts chopping you up, how will you get out?

He came up with a clever response: By rocking the blender and knocking it over. But it wasn’t enough to impress the interviewer, and Dr. Raver lost out on the job.

While odd questions aren’t necessarily common in biopharma positions, they show just how eager companies are to check and recheck that they have the best person for the job—or conversely, how picky employers can be in choosing between numerous candidates with standout resumes, experience, and references.

“The saturation of Ph.D.s is a driving force for why companies can afford to do that and why they will take more time to find the more qualified candidate. And they come up with creative ways to do that,” Dr. Raver told GEN.

Dr. Raver edits The Grad Student Way, a blog focused on helping Ph.D.s explore careers outside academia given the glut of doctoral and postdoc students compared with tenured faculty positions. By his count, he applied for 40 positions before networking his way to his current job, as a product manager for a life-sci company he won’t identify.

Dr. Raver identified four key factors in the interview processes of employers: the education required for a position, the dependence companies place in that position’s impact in driving their revenues, the company culture, and the location of job. The glut of Ph.D.s, he says, often yields the stiffest competition for jobs in top-tier biopharma cluster locations including Madison, WI, where he graduated from the Cellular and Molecular Pathology program at University of Wisconsin-Madison.

29-day Process

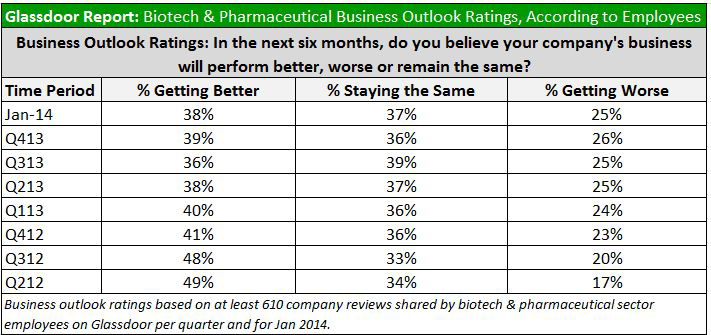

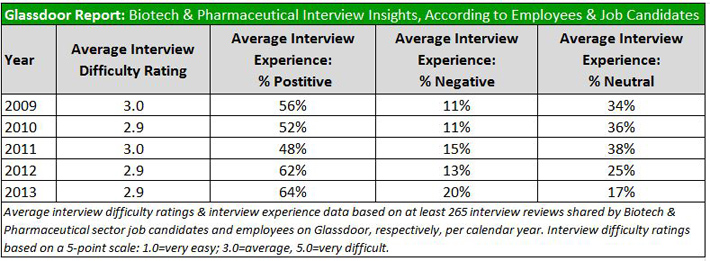

Interviews for biopharma positions took the longest among 12 industries studied last year by the online career community Glassdoor, with the process stretching 29 days—more than double the 13-day process of 2009. Education had the second-longest interview process (28 days) followed by manufacturing (26 days), with retail the shortest (15 days). The more specialized the skills, the longer the interviewing takes.

Despite the growing length of interviewing, Glassdoor also found the percentage of interviewees reporting positive experiences rising to 64% in 2013 from 56% in 2009. The increase may not simply reflect reluctance to risk future rejection by speaking ill of an employer, since the percentage of interviewees reporting negative experiences also rose, to 20% last year from 11% in 2009.

“That is likely a source of the HR representatives, the HR workers on the inside of these companies putting more time into really pinpointing and finding the right candidate, the best-fit candidate, as opposed to just a good candidate,” Scott Dobroski, corporate communications manager at Glassdoor, told GEN.

He said it’s too soon to tell what effect the big-pharma layoffs of recent months may have on interview-process lengths or satisfaction.

Mark Lanfear, global practice leader, life sciences for Kelly Services, told GEN 61% of current biopharma employees surveyed by his firm intend to make a job change this year, while 44% of life science professionals have changed employers in the past year.

That restlessness, and the nature of R&D work, makes it more essential that employers choose the right people, at risk of taking longer than in the past.

“Research and development companies are planners by nature. The long process that it takes to create therapies that affect people and that affect patients, the whole process of human clinical trials, it’s become very long and very costly. This affects the pace at which they look at their human capital allocation,” Lanfear said.

Drug-development cost estimates range from $1.3 billion (Tufts Center for the Study of Drug Development) to at least $4 billion (InnoThink Center for Research in Biomedical Innovation) over a decade or more.

“Because they’re in a situation where they’re planning out their research over long time periods, they know what’s coming. So they can plan out for these skills, and they can do a better job of critically looking at the ones that they acquire before they actually have to look at making a decision in the process,” Lanfear added.

Differences in corporate culture also explain differences in how companies hire. While big pharmas hire cautiously and slowly as they vet resumes and check references, smaller biotechs that operate at a faster pace are also likelier to hire faster.

“Their process is really more group and team oriented. Because oftentimes they are smaller groups, the groups work more in a multifunctional way across job-code lines, it’s more important for them that there’s a lot of collaboration,” Lanfear said. “You’ll see a lot of collaboratory methods in their interviewing processes, converse to bigger more established groups have clean lines between job codes, job families, things like this.”

Up with People

Whether large or small, biopharmas tend to be more people-focused than other technology specialties, where shorter lifecycles and the need for speed in commercializing products and fixing bugs results in quicker decision-making. Since clinical trials and FDA reviews take years, Lanfear said, biopharmas need to find people with the lengthy institutional knowledge that a drug development program needs, compared with the consultants that, say, a professional services firm can deploy even in the middle of a process and expect solid contributions.

“There’s a lot of art to the science that is based as you develop therapies, and some of that is built into the people that you’ve had into the program,” Lanfear observed. “It’s difficult to bring somebody in the middle of a process that’s a scientific laboratory research and development, bring them up to speed with enough knowledge to have them contribute in a short fashion.”

Lanfear said the specialized skills biopharma seeks also yield a more specialized, situational-focused interview process, with questions like “Give me a time when…” and even, “Give me a time where you failed, or where you worked against challenges.”

What was once one or two interviews with a hiring manager or higher-ups has blossomed into a series of interviews with peers, oftentimes involving folks that support the position.

As biopharmas shed jobs, companies are also stepping up their strategic planning, narrowing to core functions the positions for which they will interview people, and leaving other jobs to contract research organizations.

For 2014, Lanfear said, “We are seeing an uptick in all of our competitive roles, [in] the roles of biostatisticians, clinical research monitors or CRAs [clinical research associates], clinical data managers, [and] leadership positions. In all cross-leadership positions of the therapy area, we are seeing a greater demand.”

Dr. Raver says the people who fill those and other biopharma positions will be those who succeed in demonstrating that they add value. And adding value, he said, cuts two ways: Candidates will have to demonstrate success both with numbers, and with people.

“It’s not just about driving revenue and money, but it’s also coming up with new ways to think about scientific problems, or focus on the end user—which is the customer—and how can you add value to that customer, because without the customer, there is no company,” Dr. Raver noted.

The balancing act will prove more important this year than in recent years since many biopharma companies will continue to hire while continuing to shed jobs. The restructurings announced by AstraZeneca, Merck, Novartis, Teva, and several smaller companies include additional investment (including personnel) in therapeutics areas deemed to hold the best potential for growth.

But corresponding cuts in noncore operations will intensify the scramble by jobseekers for new positions, as will the prospect of increased competition as more than half of employees want to leave their jobs this year, and as Ph.D.s look slowly but surely to job alternatives beyond the academic lab. To get the jobs they want, candidates will increasingly need to master the interview as well as they mastered the science.