February 1, 2007 (Vol. 27, No. 3)

Last month’s J. P. Morgan Healthcare Conference in San Francisco was notable in that neither the usual extreme hype over biotech nor any type of excess negativity about the biopharmaceutical industry was evident. Rather, a more sober, not somber, business atmosphere marked the meeting than may have been the case in the past. Maybe the bioindustry has finally reached the point of being truly realistic in terms of its expectations.

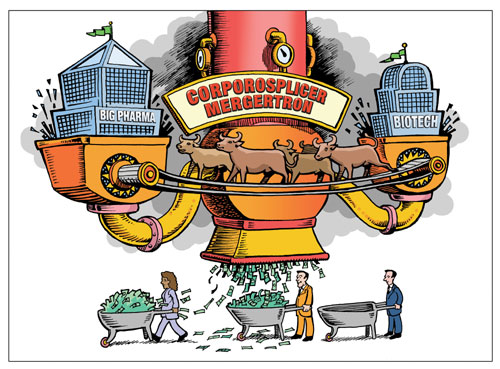

There was still concern over products failing in Phase II and Phase III trials and some industry experts expect more M&A activity in the future. And the pharmaceutical companies present seemed eager to adopt some of the best practices of their younger biotech brethren, especially regarding the need to pay more attention to basic scientific R&D.

Our annual Wall Street Roundup, which follows, should help divine what may be in store for the biotech industry in 2007. Our analysts are all keen observers of the biopharm business and their comments and predictions should be of much interest to GEN readers.

Jason Napodano

Senior Biotechnology Analyst

Zacks Investment Research

(www.zacks.com)

Carrying forward several positive trends from 2006, biotech should have another good year in 2007. Key to our favorable opinion on the industry is M&A activity. Always a driving force, M&A activity really took off late in 2006 with several big deals between large and small companies. Big pharma continues to be in desperate need of new products, and biotech pipelines are as deep now as they have ever been.

Along with outright takeovers, big pharma has been actively seeking in-license and collaborative opportunities as well. We think that tendency will continue in 2007.

Another trend we saw really starting to take hold in 2006 was the emergence of private equity firms. Several small biotechs secured financing without doing the traditional secondary offering last year. Companies are looking to accelerate clinical development without diluting shareholders or giving up product control. We think that is good for the overall health of the industry.

Besides M&A activity driving the overall industry up, individual names will be driven by product approvals or important clinical data. Within our coverage universe, several names have big events coming in 2007.

AtheroGenics (AGIX) should announce Phase III data from the ARISE trial in March 2007. The company is developing AGI-1067 as a treatment for atherosclerosis. Positive data from this study may lead to an NDA application with partner AstraZeneca later this year. The drug could quickly gain sizable market share for secondary prevention of cardiovascular events, making it a potential multibillion-dollar drug. The shorts are all over this stock, however, and we place the chances of success at 50/50. AtheroGenics could trade to as low as $3 if the drug fails or as high as $40 if the drug hits. This could be the biggest story of early 2007.

Another name that could have a big movement up or down in early 2007 is CV Therapeutics (CVTX). The company received approval in January 2006 for Ranexa, a partial fatty acid oxidation (pFOX) inhibitor, to treat refractory (second line) chronic angina. However, the company is looking to expand Ranexa usage into the first-line setting and acute coronary syndrome (ACS). Data from a large-scale Phase III trial called MERLIN is expected in the first quarter of 2007. Positive results have the potential to expand the Ranexa market from a $150-million opportunity to a multibillion-dollar opportunity. Even if the ACS data doesn’t look good, we think the safety of Ranexa reported in MERLIN should be enough to convince the FDA to allow usage in the first-line angina indication. Hence, we think CVT should be a good name to own in 2007 as Ranexa prescriptions pick up. We see profitability for CVT in 2010.

Another top pick for 2007 is Acadia Pharmaceuticals (ACAD. The company has four internal shots on goal with two proprietary product candidates. It is uncommon for such a small company to have such a deep and potentially very significant pipeline. ACP-103 is under mid-stage development for schizophrenia, Parkinson’s disease psychosis, and sleep maintenance insomnia, and ACP-104 is in mid-stage development for schizophrenia. We are looking for positive Phase II data on ACP-103 in schizophrenia in the first quarter of 2007. Acadia could look to partner this candidate in 2007, potentially bringing in a big upfront milestone. We also expect Acadia to partner ACP-103 for sleep maintenance insomnia in 2007. Over the long term, we think this name is a great biotech pure-play—that is if they don’t get acquired before the year is out.

Another name we think is in store for a great 2007 is ViroPharma (VPHM). Phase III candidate, Maribavir, is a potential blockbuster for cytomegalovirus prevention. Phase II candidate, HCV-796, looks like a big winner for hepatitis-C (HCV). Over the near-term, the company is using solid trends in sales of antibiotic Vancocin to deliver strong profitability and generate tons of cash. ViroPharma repurchased all its outstanding debt in 2006, making the company lean, mean, and ready to expand. We think the company will go on a product acquisition spree in 2007 to beef-up the mid-stage pipeline. This should work to expand Wall Street’s perception of the name as a Vancocin story only.

The final name we would get behind in 2007 is Xoma (XOMA). Xoma has been signing up licenses for its Bacterial Cell Expression (BCE) technology for years. In 2006, however, the company began licensing a new technology—Human Engineering (HE). This is an enabling technology for modifying nonhuman antibodies to make them suitable for medical purposes in humans. Xoma signed up two HE partners in 2006, bringing in upfront milestone payments and potential future royalties. We expect several more HE deals in 2007. Also in 2006, the company formed two major research collaborations with Schering-Plough (SGP) and Takeda (TPNA) that provide development milestones and potential tie-ins to future product sales.

The past few years have been great for Xoma’s contract business as well, winning nearly $60 million in government NIAID contracts for bioterrorism defense. In the meantime, Xoma will continue to collect royalties on Genentech’s (DNA) Raptiva and Lucentis and will look to bring some of its own candidates into the clinic for cancer, acne, and inflammatory diseases.

A name we would avoid in 2007 is Amylin Pharmaceuticals (AMLN). We note increasing competition for Byetta from Merck’s (MRK) recently approved Januvia. Byetta trends have been strong thanks to Amylin pushing its weight-loss benefit. However, as new DPP-IV drugs, like Januvia and Galvus (Novartis; NVS), come to market, that competitive edge will be harder to push. Finally, Amylin is an incredibly expensive stock, currently trading at over 30x our 2010 EPS estimate. That’s over a 100% premium to the industry average.

Another name to avoid is OSI Pharmaceuticals (OSIP). We are concerned that sales of Tarceva will begin to slow as penetration in non-small-cell-lung cancer maxes out due to competition for competing agents. OSI’s purchase of Eyetech Pharmaceuticals in late 2005 was an absolute disaster, and we see little reason to own the stock until OSI can shed the struggling eye business and demonstrate to investors that there is more to its story than just Tarceva and DPP-IV royalties.

William J. Kridel, Jr.

Managing Director and Founder of

Ferghana Partners and Chairman and

Co-Founder of XShares Group

(www.ferghanapartners.com)

I think there will be a number of currents in the ocean in which the biopharmaceutical industry is swimming—increased regulatory oversight on safety issues, perhaps to the detriment of patients taking a given drug that has occasional and rare adverse side-effects; debilitating political discussions on drug pricing by the press and political parties that do not take into account the true development costs of a successful drug; consolidation of companies in the same therapeutic area to build more competitive business enterprises; increased globalization with further inroads into important markets for Indian, Chinese, and newly enlarged mid-market European biopharms; and finally, further breakthroughs on the use of biomarkers and medical diagnostics.

The current state of the industry is highly tri-modal. The largest companies obtain substantial amounts of financing and human resources to enable internal and in-licensed discovery effort to replenish and extend their pipelines. Middle-market companies have good access to capital but a narrower range of replenishment opportunities. Finally, the smallest companies are frequently being eaten up or are withering away, as only the most ardent investors will focus on enterprises with limited access to capital, equity research, and business focus.

The entire pharmaceutical industry must do a much better job in explaining its true economics not only to regulatory authorities but also to the appropriate political forum in terms of legislatures and public opinion. The cost and nature of the discovery and clinical development process for drugs and diagnostics is often poorly understood. Many political, media, and public opinions are simply based on headline financial results and not on the risks and operational difficulties that have been overcome, thereby entitling the biopharma company to its revenues and profits. With generic drugs looming ever larger in the daily armamentarium of physicians and increased global competition, at least the American legal/political/economic environment must become more realistic and supportive.

As for stock picks, look for IPOs of companies that have revenues or multiple late-stage compounds based on differing platforms/mechanisms of action as these enterprises represent more mature values and will be treating the public markets more as a source of growth capital than as a source of public venture investment. Among the companies already public, medical diagnostics, biomarkers, and breakthroughs in CNS look to be excellent deals for prosperous investing in 2007.

Viren Mehta, Pharm. D.

Managing Member, Mehta Partners

(www.mpglobal.com)

Another transition year is likely to unfold in 2007 based on our analysis of upcoming drug launches, which are key drivers in the sector. We thus begin to see a light at the end of the R&D tunnel. Most of this improvement in R&D comes from rising star and global pharmaceutical companies and the collaboration between the two. New product offerings from the specialty pharma group continue to be mediocre, which should lead to aggressive consolidation to turbo-charge their meager pipelines. At the same time, the mature biotech group continues to face the same issues that global and specialty pharma have had for over a decade, namely a disappointing pipeline. Thus ultimately for many of these mature biotech companies M&A may be the only way out.

Of the seven products expected to launch in 2007, only one, GlaxoSmithKline’s (GSK) candidate cervical cancer vaccine, Cervarix, is a novel drug and that is just a royalty stream from a large pharma. Everything else is simply a life-cycle management or line-extension product. Only four blockbusters are expected between 2007 and 2011—Sevalamer Carbonate (second-generation Renagel) for end-stage renal disease, Truvada/Sustiva for HIV, the Avastin line extension in breast cancer, and Denosumab for osteoperosis. The majority of drugs will be under $500 million.

Most mature biotechs are unlikely to have a major new product approved until 2010. Even Genentech, which has historically been lauded for its pipeline, has Lucentis as the last new product approved and only label expansions likely—obviously even these are a big deal and still will allow Genentech to grow at a good pace. Biogen Idec (BIIB), Amgen (AMGN), Medimmune (MEDI), and Gilead Sciences (GILD) are all essentially in the same boat.

The therapeutic classes that helped build the mature biotech segment, namely anemia, multiple sclerosis (MS), and cancer will be facing some tough new entrants in the coming years. Amgen is facing quite a few new and serious threats to its EPO franchise. Roche is expected to gain approval for CERA in the first half of 2007 and plans to launch at-risk, unless Amgen gets a preliminary injunction. This will break Amgen’s unusual 17-year monopoly. More over, with CERA’s once every three- or four-week dosing, versus every one- or two-week dosing for Aranesp, Roche will have a significant marketing advantage.

Beyond CERA, Fibrogen’s FG-2216 and Affymax’ Hematide, both in Phase II, also have shown early data that may position them very strongly, because they are not subject to Amgen’s patents and show potential safety and efficacy advantages over Aranesp.

Biogen also faces near-term threats to its main franchise, Avonex for MS. BioPartners is expected to file for its generic Avonex in the second quarter of 2007. Although this product can only be launched in Europe, it could still have a significant impact on total sales, especially if they decide to price their compound at a discount.

There are also some novel therapies that are in late stages for MS. FTY-720 from Novartis, Mylinax from Serono (now part of Merck KGaA), and Teriflunomide from sanofi-aventis (SNY) are all in Phase III. They likely will bring a superior profile and much lower cost for an oral therapy. Campath from Schering AG/Genzyme (GENZ) and ABT-874 from Abbott (ABT) are also in Phase II. Clearly, competition is heating up in MS and will likely be a major threat to Biogen Idec’s earnings in the coming years.

Rituxan (Biogen Idec/Genentech) and Herceptin (Genentech) were able to successfully carve out niches with little competition. This model, however, is becoming harder and harder to duplicate. With Erbitux (Bristol Myers Squibb; BMY/Imclone; IMCL) about to have a major marketing battle versus Vectibix (Amgen), and Herceptin having to slug it out with Tykerb, a small molecule from GlaxoSmithKline, cancer is becoming increasingly competitive. The introduction of VEGF-TRAP (sanofi/ Regeneron Pharmaceuticals (REGN)) as early as 2009 could be a major threat to Genentech’s Avastin franchise. And let us not forget the numerous competitors in relatively small cancer indications like myelodysplastic syndrome or cutaneous T-cell lymphoma.

If our projections for 2007 and beyond are even half-way correct, then mature biotech is in dire straits given both the coming competition from the likes of global pharma and follow-on biologics (FOB), first in the EU and then the U.S. for quite a few billion-dollar products.

FOBs, or biosimilars, are coming closer to reality, especially in Europe, even if you don’t take into account the branded generic Avonex. With guidelines for an abbreviated application process already in place in Europe, Epogen and Neupogen off patent, the next batch of FOBs will begin to roll out in Europe over the next several years for some of the largest products.

While the U.S. will undoubtedly take longer to approve FOBs, it can be expected to develop biosimilar draft guidelines as Democrats in Congress address this gap, finding support from the EU guidelines, which are nearly finalized. As the older biologics don’t lose key U.S. patent protection until 2013, these guidelines will come in time to ensure that the follow-on biologics can reach the market and not be caught up in regulatory hurdles. Europe is likely to start approving FOBs before the turn of this decade.

Discount pricing for patented follow-on innovations seems the norm now, as illustrated by 20+% discount for Vectibix by Amgen, even though this fully human EGF Mab has sufficient marketing teeth over Erbitux due to its more convenient dosing regimen. In the good old days, marketers would have successfully taken such modest edges to the bank. Now, however, as more and more improved follow-on innovations are launched to compete with the primary breadwinners of mature biotech companies, we may not need to wait for FOB copies to see their earnings growth deteriorate.

When biosimilars become a reality around the end of this decade if not before, the mature biotech group lacks the products to make up for the biosimilar erosion and lost sales.

The question is what can they do to fix this problem? Unfortunately, they have to copy the global pharma and specialty pharma M&A strategy but in the process they have ended up intensifying the competition for scarce assets. This makes quality products difficult and expensive to acquire, especially as global pharma is armed with billions in repatriated profits.

Hence, mature biotech needs to be more active in in-licensing and acquiring promising products and companies. Although there may be short-term pain through dilution, long term it will undoubtedly be worth it.

Consolidation was at an all-time high in 2006, as a record 61 deals worth around $120 billion were signed—21 in October and November alone, as much as in all of 2001. In fact, the M&A activity we saw in 2006 is likely just the tip of the iceberg. With coffers flush with cash but pipelines barren, the challenge is that everyone is looking at the same small number of attractive companies to acquire, pushing up the valuations.

On the whole, the new science still seems to lead to many of the same old problems—the promise of predictable pipeline receding on the horizon, much like the global and specialty pharma sector. With a much larger sales base and high if not lavish cost structures to match those of global pharma, mature biotechs face the triple whammy—thin pipelines plus competition plus generics—only a decade later!

Is it possible that Amgen may start paying dividends or buy a global pharma? That may be the answer as many global pharma are smaller in market value, have invested heavily in rebuilding their pipeline, and some of the management teams seem like sitting ducks. Amgen and Genentech sport a market value nearly as large as those of Merck and AstraZeneca (AZN), and larger than Schering-Plough, Eli Lilly (LLY), Abbott, Bristol-Myers Squibb, and Wyeth (WYE) in the U.S., Takeda, Astellas, Daiichi Sankyo in Japan, and Bayer in Europe. Among the U.S. Pharma, only Johnson & Johnson (JNJ) and Pfizer (PFE) are larger, as are GlaxoSmithKline, Novartis, Roche, and sanofi-aventis in Europe.

Geoffrey Meacham, Ph.D.

Analyst, JP Morgan

(www.jpmorgan.com)

Biotechs underperformed the broader market in 2006 with the BTK index up 10.8% versus 13.6% for the S&P500. For 2007, our sector view is modestly positive as M&A activity, above-market revenue, and earnings growth should drive outperformance. However, the changing political environment and crowding therapeutic competitive landscapes are risks.

In 2007, the large caps should see revenue and EPS growth of 14.7% and 23.5%, forecasts that have clear upside potential. Celgene (CELG), Biogen Idec, and Genentech have, in our view, the strongest revenue and EPS upside potential in the group.

There were ten announced biotech acquisitions in 2006, up from eight in 2005 and we expect M&A trends to continue in 2007 as big pharma and to a lesser degree big biotech uses their currency. With S&P earnings decelerating from 14.4% in 2006 to 9.1% in 2007, growth in the biotech sector looks comparatively good.

Strong product launches (e.g., Revlimid, Atripla, Tysabri, Vectibix, and Lucentis) and Phase III data (e.g., Vectibix for colorectal cancer, Revlimid for multiple myeloma, tenofovir for hepatitis B, Tolevamer for C. difficile-associated diarrhea, Remodulin for PAH, MDX-010 for metastatic melanoma, AGI-1067 for atherosclerosis) should continue to drive fund flows in the sector, in our view.

The changing political landscape, including concerns over reimbursement, pricing pressure, and follow-on biologics, should remain a sector overhang, though real action is unlikely to occur prior to the next election cycle. Ironically, ample access to capital is making biotech therapeutic markets more competitive and driving more intra-industry competition. Gilead, Genentech, Celgene, and MedImmune seem competitively well positioned, whereas Genzyme and Amgen, Millennium Pharmaceuticals (MLNM) and OSI Pharmaceuticals do not. The following are our top picks:

Large Cap Biotech

Biogen Idec ($49.75/Overweight): We see upside potential in Biogen Idec shares driven by a better-than-expected launch of Tysabri and better operational leverage than is currently implied in Street consensus. We expect the Tysabri re-launch to accelerate throughout 2007. While third quarter Tysabri sales were modest, our 2007 Tysabri forecast is $357 million.

Biogen Idec did not announce a major investment in external R&D in the fourth quarter, hence, a healthy upside to fourth quarter 2006 EPS should not be surprising. Our EPS forecast for 2007 is $2.58. Looking forward, we expect Biogen Idec to continue external investments in R&D, to the tune of $200–300 million. We note, however, that the R&D spending level has flexibility, Biogen Idec remains valuation sensitive to therapeutic assets that are available, and we do not expect a major M&A transaction that is noncore or materially dilutive.

In spite of the recent “Dear Doctor” letter indicating PML risk for Rituxan in lupus patients, we believe that the Rituxan franchise is intact. In our view, Rituxan remains an extremely safe therapy whose safety and tolerability profile is well characterized with nearly a million patient exposures. Overall, we do not see significant downside to our 2007–2008 Rituxan forecasts of $2.61 billion and $3.11 billion respectively, with growth largely coming from the RA setting.

In addition, Biogen Idec shares are still undervalued, in our view. Trading at 19x our 2007 EPS estimate of $2.58, Biogen shares are still discounted compared to the large-cap biotech peer group, which trade at 31x. With high expense expectations and low Tysabri expectations, we believe Biogen Idec is well positioned to deliver top- and bottom-line upside in 2007.

Biogen Idec’s growth prospects are heavily dependent upon governmental regulatory processes and approvals. Also, if additional safety issues emerge with Tysabri, a negative impact on valuation may occur. We would also point out that additional risks that could adversely impact Biogen Idec’s valuation include the following: failure to achieve regulatory approval for additional indications for current and anticipated future products, changes in government and private reimbursement, slower than expected adoption of newly launched products, the introduction of competitive products, changes in intellectual property status (patents), and any other risks associated with investing in biotechnology securities.

Celgene ($58.04/Overweight): Celgene continues to be one of our favorite names in large-cap biotech despite 2005–2006 performance of +144% and +77%, respectively, versus 25.1% and 10.8% for the BTK index in the same periods. We expect that the next legs of Revlimid growth will come from the European launch of Revlimid in multiple myeloma (EMEA action expected the first quarter of 2007), and increasing off-label use in chronic lymphocytic leukemia (CLL) and non-Hodgkin’s lymphoma (NHL). For fourth quarter Revlimid sales, we are once again, almost Street-high at $145 million. Looking to 2007, we are formally assuming Revlimid U.S. sales of $739 million. However the range is quite broad at $689–$967 million.

What is widely ignored is the company’s mid-stage pipeline, which features CC-4047 for small cell lung cancer, myelofibrosis, and sickle cell anemia where pivotal programs are beginning in 2007; CC-10004, an oral TNF-a inhibitor for moderate-to-severe psoriasis (Phase II data expected in mid-2007) with potential in RA; and an advanced placental stem cell program. Visibility on these programs, which are not in our model, as well as Revlimid in CLL and NHL should continue to increase in 2007, highlighting the value conferred in Celgene’s IMiD franchise as well as the blockbuster opportunities for Revlimid beyond multiple myeloma and MDS.

Revlimid gross margins of 95%+ have transformed Celgene’s P&L since its market introduction as seen by gross margins, which have increased from 79% in the fourth quarter of 2005 to 85% in third quarter of 2006. Now that the European infrastructure for Revlimid commercialization is largely built, we see margin expansion on the operating side looking to 2007. Our operating margin assumptions for 2007–2008 of 41% and 46% look conservative as do our 2007–2008 EPS forecasts of $1.00 and $1.44 (excluding European sales of Revlimid).

Although Celgene is currently trading at 58x our 2007 EPS estimate of $1.00, versus the group at 31x, EPS is expected to top 81% (large cap group: 24%). Accordingly, Celgene’s P/E/growth ratio of 1.7x is still attractive, in our view compared to the peer group average of 1.8x (P/E/growth ratio calculated using four-year EPS CAGR).

We identify three primary risks to our overweight rating. First, Thalomid or Revlimid sales could fluctuate from quarter to quarter due to competition with other drugs, such as Millennium’s Velcade. Second, additional data from Revlimid clinical trials, either for multiple myeloma or MDS could come in below expectations and have a significant negative impact on Celgene shares. Third, there is headline risk associated with the generic thalidomide in the U.S.

Small/Midcap Biotech

Incyte (INCY/$6.19/Overweight): For 2007, we view Incyte as holding significant potential for investors given its broad and maturing pipeline of clinical candidates. Few biotech companies of Incyte’s size can boast the potential of having six candidates in the clinic for six different indications by the end of 2007. Incyte is anticipated to have Phase II trials ongoing for its sheddase inhibitor for cancer, CCR2 antagonist for MS, CCR5 antagonist for HIV, and its 11beta-HSD1inhibitor for type 2 diabetes. In addition, Phase I trials are expected to be under way with two yet undisclosed candidates for both cancer and inflammatory disorders.

Beyond the $800-million deal that the company signed with Pfizer in November 2005 covering its CCR2 program, except MS and one other undisclosed indication, Incyte has retained all rights to the other products in its pipeline. We therefore believe there could be further opportunities for the company to sign licensing deals during 2007 or if it chooses, take some of the products forward itself. With more than $425 million in cash, cash equivalents, and marketable securities, we believe the company has greater financial flexibility to determine when such deals should be made.

We believe that Incyte is presently undervalued. We anticipate that valuation will continue to be tightly correlated with the success/failure of the company’s early-stage pipeline, but the company’s current cash position ($5/share) should sufficiently allow it to continue development and meet short-term debt obligations.

Risks to our rating include the failure of Incyte’s CCR2 receptor antagonists and/or the failure of Pfizer to develop these products, resulting in reduced milestones and royalty payments. The failure of the company’s earlier-stage programs also represents a long-term risk.

Shire (SHP LN/1092p/Overweight): Shire is our long-term top-pick as it is in the midst of a robust product cycle, which supports mid-teen’s five-year earnings growth with the potential for significant upside. The company is launching two products currently (daytrana for ADHD and elaprase for Hunter syndrome) and is expected to launch five in 2007 (NRP104 for ADHD, mesavance for ulcerative colitis, dynEpo for anemia-related to chronic renal deficiency, SPD465 for ADHD, and SPD503 for ADHD). We expect these products to contribute over half of Shire’s revenues by 2011.

We foresee increased focus on the human genetic therapies (HGT) business, as it will likely be the next major value driver after the launch of NRP104 and Mesavance in the first half of 2007. By 2011, we estimate HGT will contribute 25% of Shire’s total revenues, up from our projected 14% contribution in 2007.

Our current five-year low-teen’s revenue growth estimate is predicated on conservative assumptions for new products. We estimate there could be $1 billion in revenue upside by 2011. If half of the potential upside is realized, revenue growth would increase to the high teens.

Shire is trading at a 7% premium to its European mid-cap biopharma and a 4% premium to its U.S. specialty pharma peers on 2008 IBES consensus earnings.

In our view, Shire is one of the few European mid-cap biopharmaceuticals companies capable of generating mid-teens earnings growth over the next five years without exerting heroic efforts. Hence, we believe additional premium to peers is warranted.

Risks to our rating include: earlier-than-expected generic competition for Adderall XR, regulatory delays for new product approvals, and disappointing new product launches.

United Therapeutics (UTHR/$53.66/ Overweight): We view United Therapeutics as a top mid-cap biotech pick for 2007. We believe United trades at an unwarranted discount to its peer group given continued superior bottom-line performance and our expectations for further outperformance. Following a difficult 2006 (-21%), we believe the company’s shares are poised for substantial upside in 2007, driven by above-consensus Remodulin growth and thus EPS outperformance, as well as positive inhaled Remodulin pivotal results mid -year.

We expect Remodulin will continue to exhibit strong growth, where our 2007 estimate of $180 million is ahead of consensus, driving EPS outperformance. We view the Remodulin franchise as underappreciated. We believe any lingering concerns regarding increased sepsis risk with IV Remodulin should be mitigated when the CDC issues its definitive report, which should be in line with a “Dear Doctor” letter sent out in late November, which the CDC reportedly signed off on.

We view the Remodulin franchise as well positioned, where we expect SQ/IV Remodulin will drive near-term growth, followed by inhaled Remodulin, which should drive medium- to long-term growth in the PAH market.

United’s P&L continues to offer significant EPS leverage driven by tight expense control and a minimal share count. The levered P&L backbone has historically allowed United to deliver significant EPS upside, where key value driver Remodulin’s gross margins are in the order of 90%. Indeed, United recently increased its P&L leverage with the buy back of 1.8 million shares of common stock, in addition to committing to buy an additional 2.2 million shares in the next two years. We expect United will remain committed to strict control of the P&L.

We value United shares using a forward earnings multiple that we believe appropriately accounts for the significant leverage in the model. United is currently trading at 21x our 2007 EPS estimate of $2.55 (pro forma), a significant discount to the profitable biotech mid-cap peer group and not fully reflective of the company’s significant EPS growth potential over the next few years.

We identify three primary risks to our Overweight rating. The primary near-term risk is the clinical risk associated with the ongoing Phase II/III trial of inhaled Remodulin.

Should the trial not reach statistical significance, additional studies would need to be conducted, leading to a delay in the timeline for the drug reaching the market. The same risk applies for Phase II/III trials of oral Remodulin, which also have the potential to be registration studies. Should United choose to file in these indications, the company faces regulatory risk when the FDA decides on the drug’s application.

The third risk associated with our rating is commercial risk, as United markets Remodulin in a highly competitive space against more experienced and better-funded biopharmaceutical companies, and could miss Street consensus forecasts for quarterly financial performance.

Rod Raynovich

Principal, Raygent Associates

(www.raygent.com)

Our expectations for 2007 are more realistic after a lackluster 2006 where the various biotech indices failed to surpass 2005 highs. Despite all the brainpower and experience managing healthcare and biotech funds, the returns were a meager 6% at the high end and an average of 1.2% for the health science category, according to Morningstar.

Many mutual funds in the healthcare sector actually had negative returns when expenses were taken into account. Of course, there may be hedge funds playing the sector that have huge returns because of their ability to create momentum, short stocks, and concentrate their bets on a few speculative small-cap companies.

For 2006 in the large-cap sector, big winners, such as Celgene and Gilead, were countered with losers, like Amgen and Genentech. Among the small/mid-cap stocks under the $1-billion market cap, my index of 20 stocks is instructive. Despite huge winners, like Myogen (MYOG)<, Array BioPharma (ARRY), and Alnylam Pharmaceuticals (ALNY), the Index was down 10%, as half of the stocks were in the red with approximately 50% losses due to failed clinical trials. The bellwether ETF IBB is still stuck near its 2004 and 2005 highs of 80.

A big concern for biotechnology is the high rate of drug failure in Phase III despite all the new discovery and development tools, such as genomics.

With S&P returns of 15%, international and real estate sector returns of around 30%, and natural resource plays in the 15% range, life sciences stocks could easily be ignored in 2006. However, 2007 should be a better year than 2006 for the following reasons.

M&A activity will drive stocks with acquisitions of small- and mid-cap companies that have Phase II validated products or existing revenues. There are plenty of synergistic combinations to be played out.

Money will flow out of hot sectors, like cyclicals, energy, communications, and emerging markets and find their way into life sciences especially if global economies cool. Liquidity will remain due to low interest rates.

Drug pricing pressure is not likely to be a factor, despite all the rhetoric from the Democrats, as the industry offers good value both as investments with the large caps and innovative products in the pipeline of small and mid caps. If the politicians want to attack healthcare costs they should go after the 20–30% waste in the bloated bureaucracy, much of it in managed care and insurance.

New technologies and themes, such as RNAi, targeted therapies, kinase inhibitors, immunomodulation, stem cells, smart vaccines, and genomics, should finally improve drug development productivity and spur investor interest.

Steller clinical developments and headline healthcare breakthroughs, as always, will drive stocks.

It is always difficult to make picks at this time of the year as many stocks are at their highs due to seasonal factors, including small-cap fourth quarter strength, the January effect, and life science conferences. Hence, building a portfolio requires a certain timing and trading acumen.

So, with the goal of getting a 10% return in 2007, the following model is offered.

Stay 50% invested in large caps, 25% in ETF’s or mutual/hedge funds, and 25% in small and mid caps. Overall we see the sector at equal weight but overweight biotechnology within a healthcare portfolio.

Last year I got lucky picking leaders, such as Celgene and Gilead, so this year I’ll add some laggards like Genentech with the following big-cap line-up:

50% in Amgen, Biogen Idec, Genentech, Gilead, MedImmune, and Wyeth

Another 20% in ETF’s IBB and PBE

Mid-cap picks are Alnylam, Cubist Pharmaceuticals (CBST), Exelixis (EXEL), Medarex (MEDX), and Myriad Genetics (MYGN).

Emerging company picks include Array BioPharma and MannKind (MNKD).

Wildcards are AtheroGenics and OSI Pharmaceuticals

For trading and rebalancing, I offer the following tips.

Watch daily MO and volume upticks, avoid stocks with chaotic or toppy chart patterns.

Establish core position then rebalance and add in weak second quarter-position portfolio for fourth quarter.

Check out institutional holders of small- and mid-cap positions on Yahoo and NASDAQ sites.

Nola Masterson

Managing Director, Science Futures Capital

(www.sciencefuturesinc.com)

For 2007 the biotechnology industry will continue to find a receptive audience with the hedge funds that have made money with select companies over the past year. Additionally, the signs are brightening for the broader group of more traditional investors as well. The number of hedge funds that have become active in this sector has increased, which should be a good omen for the coming year. M&A activity by the large pharma companies should remain at a high pace and even large biotechnology companies will join the action as they try to fill their pipelines for the futurethe future. Also, other partnering transactions for sought after products and platforms are likely to command high valuations as buyers weigh the economics of external transactions against their internal R&D productivity and development costs.

The market for IPO’s also looks more receptive than it has for some time. Even the large caps could have a good year, if the capital markets continue to see critical product candidates advance or major older products gain important new indications.

Yet, more challenges are looming. The new Congress may have a damping effect on the price of all prescription drugs. Biotech drugs could become subject to the same kind of price pressures as global pharma, as Congress explores ways to facilitate bringing generic biologics to market.

The new product-development path is increasingly challenging, inefficient, and costly. The number of new drugs and biologic applications submitted to the FDA has declined significantly, and the number of new drug approvals has been glacially slow. The FDA is being challenged to bring predictive models into its approval process. In addition, the promise of personalized medicine will be tough to achieve with the current set up of FDA, Centers for Medicare & Medicaid Services (CMS), CLIA, and NIH. The agencies have no incentive to work together or to agree on standards.

On the other hand, Medicare has become an agent of change as they assume leadership to improve patient outcomes and get more value for their money. CMS will increasingly play a role in setting pay-for-performance standards to incentivize providers to adhere more closely to clinical guidelines. As a result, providers will increasingly turn to pharma and biotech companies for products whose performance can meet a more rigorous standard for evidence based care.

The Internet will continue to enhance its role as the preferred channel to educate the consumer and could become an ally for the biotechnology industry. Healthcare related information technology, in the form of electronic medical records for the physician and personalized health records for the consumer, are seeing signs of great promise. E-marketing on the web is gaining traction also, and an on-line health insurance company, eHealth, showed partnerships traction as well as IPO success in 2006.

The capital markets will remain selective this year. The sweet spot for fund raising will depend on proof- of- concept or advanced human data, and successful product extensions.

Picks for 2007: Next-generation products are needed for Alzheimers, depression, and other neurological diseases. A controversial stock to watch here is Neurochem (NRMX), which will report the results of their large pivotal18- month Phase III study in the spring. Other recommendations for 2007 include Amgen, Repros (RPRX), GenProbe (GPRO), Boston Scientific (BSX), Biogen Idec, Imclone (IMCL), Cepheid, Corcept (CORT), and Baxter (BAX).