November 1, 2007 (Vol. 27, No. 19)

Shankar Sellappan Ph.D.

Employment of LC for Commercial Life Science Applications Stimulates Market Growth

L iquid chromatography (LC) has evolved from primarily a life science research-dedicated tool to a technology utilized for commercial applications such as for drug manufacturing and quality assessment of pharmaceutical/biopharmaceutical products. The spread of this technology to new classes of users is the primary driver for the U.S. liquid chromatography market right now, and the development and refinement of liquid chromatography products reflect this changing end-user base.

A key reason for the expanded use of liquid chromatography across life science disciplines and why it is so sought after as a separations methodology is that it provides a greater level of efficiency than other separation approaches can achieve for processing high volumes of biomolecular- or chemical-based samples.

As cost concerns and budgetary restraints resonate throughout the life science industry, liquid chromatography instruments capable of performing molecular separations with higher resolution, those that are able to process high quantities of samples, and those designed for constant use are of most interest to commercial users.

LC Consumables Market

As a result of the surge in life science commercial use and escalating research use, there has been concomitant growth experienced by market participants who provide columns, resins, and other consumables needed for liquid chromatographic analyte separation. LC market participants are proactively introducing products that are adapted to these shifting needs. Technological innovations and improvements in design have also promoted the use of liquid chromatography among a more diverse base of users.

For example, resin particles that are less than two microns in size offer significant efficiency and cost benefits in terms of the number of molecules captured per resin molecule, and these novel particles can be adopted for any number of applications.

Going forward, a major challenge that could limit the market’s ability to maintain historical growth rates is whether or not the level of innovation that has driven previous years’ strong market growth can be sustained. High growth rates, however, could be maintained by the shift in the end-user base. In addition, there is a lack of competing technologies that can achieve the levels of separation achieved with liquid chromatography, prompting users to prolong their use of LC technologies for separation needs.

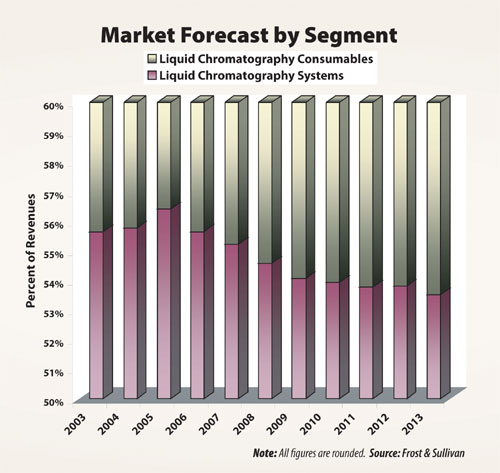

The market outlook in the U.S. is positive for liquid chromatography products through 2013, as investments in this area continue to be made by both commercial and research users. Revenues earned by market participants for liquid chromatography products in the U.S. were estimated at $596.3 million in 2006, and the market is expected to continue growing through 2013, when revenues are estimated to reach $1.018 billion.

The compound annual growth rate for the U.S. liquid chromatography market from 2007 to 2013 is expected to be 7.9%, which is reflective of the strong growth fundamentals seen for this technology in the various life science areas in which it is employed.

Shankar Sellappan, Ph.D., is an industry analyst with the drug discovery technologies and clinical diagnostics group of Frost & Sullivan, a global growth consulting company.

Web: www.frost.com.

E-mail: [email protected].