November 15, 2010 (Vol. 30, No. 20)

Robert Yuan, Ph.D.

Globe-Trotting Patients Most Often Seek Inexpensive or Experimental Treatment

Outsourcing of manufacturing and services is a reality of today’s globalization. Medical treatment appears to be next on the outsourcing list as we are now seeing vigorous growth in the number of patients traveling across national borders for healthcare purposes. The term “medical tourism” is loosely used for outsourced services including dentistry, weight loss, cosmetic and major surgery, and advanced therapies such as organ transplants.

A 2008 Deloitte report indicated that 750,000 Americans went abroad for medical treatment in 2007, and it projected 10-fold growth over the next decade. A 2009 United Nations Asia Pacific report estimated that medical tourism is currently worth about $40 billion (including the traditional tourism component).

The growth of international patient care (IPC) is driven by several factors, chiefly high medical costs and delays in getting timely treatment in patients’ home countries. The number of medical centers around the world that provide high-quality treatments at considerably lower cost without lengthy delays is proliferating. In fact, it is now possible to schedule a surgical procedure such as a heart-valve or hip replacement abroad that may be a fraction of the cost of what it is in the U.S.

The benefits of IPC must be weighed against the significant pitfalls including spotty regulation, inconsistent liability laws, and the likelihood that the patient will be responsible for the costs in the absence of insurance reimbursement.

The emerging IPC industry has three principal components: a specialized travel company that seeks to match patient needs with the capabilities of foreign medical centers and makes the necessary travel arrangements; a medical center that has the appropriate facilities and skilled medical teams; and certification by a recognized accreditation organization, in particular the Joint Commission International (JCI). This accreditation assures patients that the quality of medical care is comparable to that offered in recognized hospitals in the U.S. and EU.

A 2008 McKinsey report indicated that 40% of international patients are seeking the most advanced treatments, while 32% are looking for a higher level of care than available at home. While much of the demand for IPC comes from the U.S. and the EU, there is a rapidly expanding coterie of affluent patients from Asia and the Middle East seeking these services.

Asia has seen a rapid increase in IPC triggered in part by the Asian economic crisis of 1997 and by government efforts to modernize healthcare systems. Most Asian countries have government-provided healthcare as well as private hospitals. The economic crisis devastated healthcare budgets and decreased the number of patients at private hospitals. Many of these private hospitals are now seeking foreign patients to bring in much-needed revenue.

The number of medical centers around the world that provide high-quality treatments at considerably lower cost without lengthy delays is proliferating. [© maska82 – Fotolia.com]

Country by Country

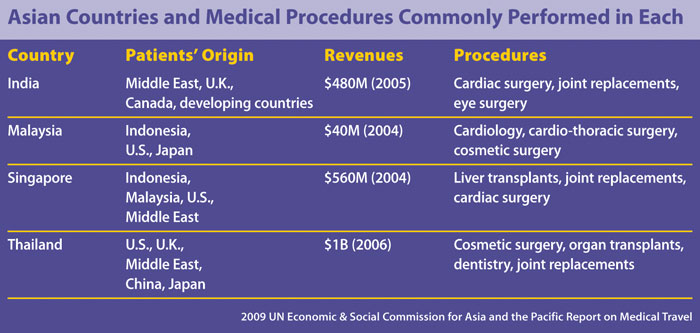

In 2005, India, Malaysia, Singapore, and Thailand welcomed over 2.5 million international patients. The Table summarizes patients’ origins, revenues, and most likely treatments available in these countries.

A country’s IPC potential can be ascertained from its number of JCI-accredited medical centers.

Singapore and India each have 16, Thailand has 11, Korea boasts 7, and Malaysia has 6. Singapore and Thailand have been the most aggressive in developing their IPC industry, and India and Malaysia are playing catch up. Thailand generated the largest revenues, followed by Singapore and India. South Korea and Taiwan are far behind but hope to use their success in high technology to create major medical centers.

At this time, Singapore predominantly attracts patients from Indonesia and Malaysia; Thailand draws large numbers of patients from Japan; and both India and South Korea attract many of their own expatriates. The Middle East and China are attractive markets for all of these countries, and aggressive marketing campaigns are ongoing in these countries.

The level and type of medical expertise also tends to vary by country. Singapore and India are generally recognized as providing advanced medical treatments, while Thailand and Malaysia provide a mixture of both medical procedures and dental and cosmetic treatments. Taiwan’s government is promoting its expertise in joint replacement, cardiovascular operations, in vitro fertilization, facial rejuvenation, and liver transplants.

Private Sector

IPC is not entirely the bailiwick of governments and medical centers. Some companies have entered the fray and are working to establish a competitive advantage by offering advanced treatments that are not always offered in industrialized countries.

For instance, STC Life operates a clinic in Seoul that uses stem cells to treat cancer and immune diseases. It plans to open another facility in the economic zone of Jeju to target patients from China and Taiwan.

Thailand’s Bumrungrad Hospital was the first JCI-certified hospital in Asia. It has 1,000 doctors, half of whom were trained abroad. Bumrungrad boasts that it can perform a heart bypass operation for $24,600, as compared with $130,000 in the U.S.

In 2005, Bumrungrad International Ltd (BIL) was created to acquire, develop, and manage medical facilities throughout Asia and the Middle East. BIL operates the Asian Hospital and Medical Center in Manila, Philippines; has a joint venture to build and operate Bumrungrad Hospital Dubai; and manages the Al Mafraq Hospital in Abu Dhabi City.

Parkway Hospitals Singapore runs 16 hospitals with more than 3,000 beds in Asia including Singapore, Malaysia, Brunei, India, and China. It also has a network of 35 ParkwayHealth Patient Assistance Centers. Two major Asian financial groups are currently competing to acquire Parkway Holdings. One is Fortis Healthcare, a Delhi-based group of Indian hospitals, the other is Khazanah, Malaysia’s sovereign fund.

To date, U.S. companies and institutions have generally ignored medical outsourcing. One exception is Johns Hopkins University, which owns and operates Singapore International Medical Centre, an oncology facility. The outsourcing of medical care may be at an early stage, but it would be unwise for U.S. companies to ignore its potential.

Robert Yuan, Ph.D. ([email protected]), is professor emeritus of cell biology and molecular genetics at the University of Maryland in College Park.